Sunday, June 30, 2024:

Trading on Friday went okay. My plan from the night before was to look for opportunities to sell bear call spreads on Friday. There was an important economic report being released at 9:45 AM, and I waited until after the release to trade. When the report was released, the market started to climb towards the $20,130 level, where I wanted to sell bear spreads above. I didn’t wait the 15 minutes I usually do to see where the market is going after a report and instead jumped in right away after the initial bullish reaction. Within a few minutes, NQ broke through the $20,130 level and kept rising, so I was forced to close my trade at a decent loss of $12.50 per spread, netting me a total loss of $1,250 ($12.5 * 20 * 5) on that trade. There are two opportunities for growth from this trade.

Lessons Learned:

- If you are going to trade a reversal, wait for either a reversal on a smaller time frame (5 minutes) or a clear rejection of the level on the 15-minute chart.

- Wait until at least one 15-minute chart forms to make a decision.

Later that morning, the market kept rising to another important level of $20,300. At this time, I decided to sell more bear call spreads. The market did reject this level, and I was able to profit from this trade.

Thursday June 27th, 2024:

Trading did not go well today. Going into today, I was primarily looking to sell bear call spreads based on my analysis from the night before. In the pre-market session, NQ kept bumping up against the resistance at $20,000. I like to get some confirmation of a rejection of a level before I sell spreads above that level. Once the market opened, however, it climbed above $20,000 and was trading around $20,020. Given my bearish bias from the previous night’s analysis, I assumed it was a false break of the $20,000 level and that the market would drop below it again. I sold bear call spreads with a short strike at $20,070, but the market began to move up immediately after. The market came back down to near the $20,000 level, and I greedily tried to close my trade at a profit instead of just closing for no gain once I saw my trade wasn’t working out. I ended up closing my trade at a loss of $7.4 per contract. The lessons from today are the following:

Lessons learned:

- Don’t let analysis of news overpower your analysis of the technicals. If the market has broken through resistance, you can’t assume it was a false breakout just because you think the news is bearish. Technicals are king.

- Never place a bearish trade at a resistance level if the market has broken it and is trading above it. The same rule applies for bullish trades below a broken support level.

- If you make a bad trade and the market gives you the opportunity to minimize your losses, take it. Don’t get greedy and try to turn the trade into a profitable one.

Sunday June 23rd, 2024:

Trading was not profitable on Friday and a few good lessons came up. I stuck to my plan on Friday of selling bear call spreads but had to do it at a lower strike price then I had planned on on Thursday night. This was due to the market having dropped in the pre-market. I entered my trade at around 10:01 AM and the market traded mostly flat for 40 minutes before making a slight move higher that approached the short strike price of my call spreads. When it hit 10:50 AM, I knew I had a maximum of 10 minutes left to exit my trade, seeing the market was going up and approaching my short strike I exited at a loss of $3.5/contract. Below are the things I could have done better:

Lessons Learned:

- Don’t trade on days that ANYTHING from the Fed is being released:

- I already have a rule that I don’t trade on FOMC meeting days or on days where FOMC meeting notes are released. But I did not have a rule for what to do on the 2 days of the year when the Fed releases their Fed Monetary Policy Report. Going forward these days will also be days I don’t trade. This report gets released at 11:00 AM, and it prevents the Implied Volatility from being sucked out of options in the morning, as IV remains elevated until after the release of this report.

- Observe the charts carefully:

- I placed my trade right after the previous 15 minute candle had made a bullish reversal pattern from the original drop the market had after it opened. Next time I see that, I should wait until a new reversal pattern to the downside forms before entering a bearish position or wait until the bullish reversal is confirmed and enter a bullish position.

- I entered my trade when the market was approaching but not at the resistance line which I thought might serve as a reversal area. In the future I should wait until the market is at or much closer to the key level before placing a trade. This will allow me to sell spreads with a short strike that has a larger safety margin away from the level I am monitoring.

Monday, June 17th, 2024:

Trading went well today. I sold 5 bear call spreads right after the market open. NQ dropped briefly after the open and I was able to close out my position with a $400 profit 13 minutes after I opened it. The market went on to recover and have a +1.23% day. Days like today highlight why trades have to be closed within an hour from when they are opened. Today is the kind of day where if trades were held for a long period, my trade would have gone from being a winner to being a big loser.

Sunday, June 16th, 2024:

Trading on Friday went well. I was looking to sell bull put spreads if NQ came tested and rejected its $19,800 support level. NQ traded below this level in the premarket and then bounced convincingly higher from there. I was able to enter into the bull put spreads I wanted and exit the trade 13 mins later with a decent profit.

Tuesday, June 11th, 2024:

Trading went well again today. Today I felt it was right to deviate from the trading plan outlined the day prior on Tomorrow’s Trade Ideas. Based on yesterday’s analysis a large move down seemed more likely than a large move up, although a large move in general didn’t seem likely. Based on this, I had outlined in my trade plan that I would be looking to sell bear call spreads on NQ with a short strike as close to the $19,190 resistance as possible. Once the market opened today, however, the market dropped and the premium I would receive for selling bear call spreads close to the $19,190 resistance would not have provided me with the $10 premium per contract I need as a minimum. Then NQ formed a clear reversal pattern off of the $18,985 support. This in combination with the fact that there was no clear bullish or bearish news made me feel comfortable to sell bull put spreads instead. I sold them with a short strike of $18,980, a strike price right below the support that had been rejected. The market continued higher after bouncing off the support and I was able to close out my trade for a profit of $400 before taking trade commissions into account. This was a fast trade where I only had to hold for 12 minutes.

Tomorrow I will not be trading as FOMC rate decision days tend to have elevated volatility and the implied volatility of options doesn’t drop during the first hour of trading like it does on most other trading days.

Lesson:

Today reminded me that you can never go with a hard-set plan into the day. There is always a possibility that you might have to adjust your trade plan based on the trading action you see in real-time. The important part of my nightly analysis is to really understand all the risks for large movements to either direction that will be present on the following day, and to have a baseline read on NQ and its large components’ charts.

Monday, June 10th, 2024:

Trading went well today. I stuck to my plan from Sunday of selling bear call spreads on NQ with a short strike as close to $19,175 as I could while still getting $10 in premium per spread. In the first hour of trading NQ was bouncing between the $18,985 and $19,025 levels. On one of the early bounces to $19,025 I was able to enter my position by selling 5 bear call spreads with a short strike of $19,080. The market bounced back down to the $18,985 area shortly after and I was able to close my position 19 minutes later with a profit of $375. Later on in the day the market rallied, eventually closing at $19,113, significantly higher than the short strike of my spreads. Had I held my trade to expiry at the end of day today, my trade would have materialized into a large loss. This is a good reminder why closing out the position when an opportunity presents itself is a must. We don’t want winners to turn into losers.

Sunday, June 9th, 2024

Friday went well. I stuck to the trading plan that I had determined on Thursday night and posted on Tomorrow’s Trade Ideas. The market reacted negatively to the 3 job and wage reports that were released at 8:30 AM and I was able to sell 5 bull put spreads with a short strike of $19,940 at 9:12 AM for $10 in premium per spread. The market bounced higher off of the $19,025 support that had been identified on Thursday and I was able to close out my position for $6.25 per spread at 9:51 AM for a profit of $375 before taking commission costs into account.

Thursday, June 6th, 2024:

Today was a good start to my 12 day paper trading period. I executed the trading plan that was outlined yesterday in the Tomorrow’s Trade Ideas page. NQ’s price climbed slightly after the unemployment report at 8:30 AM, so I waited until the price of NQ reached close to $19,090 to sell 5 bear call spreads with a short strike of $19160 for $10/contract. This was a decent premium for the spreads and I was able to sell them at a higher strike price than the $19150 resistance line I identified yesterday. After 41 minutes, the market had a slight drop and I was able to close out my spreads for $6/spread, making a profit of $400 before taking commission costs into account.

Wednesday May 29, 2024:

I have performed an analysis on my Nasdaq option spread trades that took place between January 12, 2024 and May 10, 2024. The goal was to see if there are any obvious changes that I should make for when I fund my portfolio again. Here are my findings:

- I have a net PNL of +$1,300 for bearish call spreads. I made191 trades of this type

- I have a net PNL of -$20K on Nasdaq bull put spreads sold. I made 131 trades of this type

- I had a positive return in every type of trade risk except for the 3X-5X risk category (The category with most trades) – (3X-5X means that my max return was 3X-5X smaller than my max possible loss)

- 1X-3X risk category had the win rate that most closely matched the expected win rate and a positive PNL of +$9,800

- The 1X-3X risk category also had the lowest average max loss, and an average risk of 2.28X ($12.20 credit on a $40 spread or a $24.40 credit on an $80 spread trade – This is 2.28X because my max gain is the $12.20 credit but my max loss is $27.80. $27.80 is 2.28X larger than $12.20) ($40 spread means that the option I sell has a strike price that is $40 away from the strike price of the option I buy)

- Trades held less then an hour had a net PNL of +$31K, trades held 1-2 hours had a PNL of +$7.3K, trades held 2-4 hours had a PNL of -$18.2K and trades held more than 4 hours had a PNL of -$36.4K

- When I adjusted trades over 2 hours to see what the PNL would have been had I cut the trade off at the 1 hour mark, they produced an estimated loss of $52K, only slightly better than my actual returns.

- Total commissions paid of $13,532.57 and total PNL of -$17,314

- In the 1X-3X category, I was better off closing trades when I did, then had I closed everything at a maximum of 1 hour after opening the trade. My PNL in this category would have dropped by $3,155 if I had closed everything at the 1 hour mark vs when I closed

Based on these findings these are my conclusions:

- I must have some type of trading edge worth pursuing further because having a positive PNL on 191 bearish trades would be close to impossible otherwise. This is further exemplified by the positive P&L I have for every risk category aside from the 3X-5X category.

- I must have an edge in being able to detect key levels and likely move when these key levels are reached. If this weren’t true then my best category would not be the 1X-3X category, as this is the category I trade in when the market is reaching one of my predefined levels of interest.

- Based on my analysis of the duration of each trade, there isn’t clear evidence that it has an impact.

- I want to focus on trading spreads in the 1X-3X risk category, when the market is close to a defined level. On days where no clear level is near, I will not make a trade, or will make an iron condor trade if I think volatility will be limited.

Sunday April 28, 2024:

Going into next week, NQ (Nasdaq Futures) is approaching its 21 day Moving Average, AAPL is in a bearish pattern and about 7%-8% off of its next support, and reporting earnings on Thursday. The FOMC is set to make its rate decision on Wednesday. SMCI is reporting on Tuesday and QCOM on Wednesday. TSLA seems to have reestablished itself above the $150 support level, NVDA seems to have reestablished its bullish trend but is resting right at the $872 resistance. Google is breaking out and MSFT seems to have reacted softly to earnings and is below its 20 day MA and resting at a $406 support. The markets might be displaying a complex pullback on a newly established bear market but that is yet to be seen.

Going into Monday, pending any news I will simply trade based on technical formations at key levels. After SMCI reports Tuesday and FOMC decision Wednesday, I will be able to use the news to help confirm my technical patterns.

Friday April 26th, 2024:

This was a tough week, I had 2 bad days but particularly a really bad day on Thursday which set my portfolio back a lot. I executed a trade after my 11 AM cutoff which resulted in a large loss of $7.5K. In this trade, my rule to exit was hit and I held on in hope of a turnaround. The trade was made primarily out of greed to make up for a prior bad trade in the morning. The day before, I had one of my best days, but it had been built around making trades outside of the rules. Making trades that don’t conform to the rules blur the lines about the rules. I think this is setting me back a lot. Leading up to this moment I have subconsciously been trading with the intent to have my trading replace my work income. This has led to these line blurring moments and making unnecessarily aggressive trades when not needed. For the next part of the experiment my goal will be to fully remove my greed and make trading decisions solely based on the “edges” I perceive I have, with amounts of money that will not impact me emotionally day-to-day. At the end of the day trading will only be successful if I build a consistent system, not if I have big one-off wins.

What are the edges I perceive I have:

- Ability to identify levels well

- Good understanding of the main drivers of the market

- Ability to see shapes, trends and patterns in the markets price movements

- After a pattern around a pre-identified level builds, identifying the direction of the next move

- Having time value work for me

What are my downfalls:

- Inability to stick to my rules

- My timing of exits

- Sometimes being too eager to enter a trade

- Getting emotionally affected by the results of individual trades

- Not holding winners long enough and holding losers too long

I can adapt my system to better play to my strengths and overcome my weaknesses by adding more rules to address both.

Thursday April 25, 2024:

Trading went really poorly today. I started the day off by making a quick profitable bear call spread trade on NQ (Nasdaq Futures) after the GDP report missed expectations. I then tried to follow that up with a continuation to the downside trade by selling more bear call spreads where I was short the $18400 strike. The price eventually bounced clearly off of the $18330 support and above the short strike of my call spread. I was forced to close at a loss and was down $1k on the day at this point. I broke my rule of not trading after 11 am at this point and proceeded to sell more call spreads with a short strike of $18520, on the premise that the day was likely to be a tight range day. The market continued to rip higher and after a clear break of the $18470 resistance occurred, I decided to hold on to my trade, more likely out of hope than anything else. This did not work out and I ended up losing $7K on this trade, ending the day more than $8K down.

I wrote down new rules that will help me execute better in the future. Essentially, my strength lies in identifying levels, more then in identifying what will occur once price reaches those levels. Going forward, I will wait for confirmation patterns out of those levels and mix in my understanding of market variables to determine whether a trade should be taken or not once a pattern near a resistance/support occurs.

Wednesday April 24, 2024:

Trading today went well. I was able to execute the gameplan from yesterday, but could have definitely improved on my entries. I might have entered my trades too early, although I was entering once the support seemed broken. I sold a bit too close to the resistance level I was trading around and was forced out of my position a couple of times at a loss. I was able to close the morning session up $2K, and then I entered into a trade that I should not be engaging in as it is closer to a coin toss. I sold a lot of call spreads on the market prior to close, on the expectation that META would sell off after they reported, bringing the market down with it. This theory was on the thesis that last Friday’s large drop must have been foreshadowing some type of bad news this week. Meta beat on revs and earnings but gave lower then expected guidance for next quarter causing the stock to drop heavily. In their call they emphasized their investment into AI going forward as did IBM. IBM mentioned that clients were tightening budgets and that had hurt revenues. This was not taken well by MSFT which dropped 2% after hours.

From the spreads I sold going into after hours, I was able to close that at a $1.7K profit. Putting me at a total day’s profit of $3.7K. Overall my exits were executed well, but my entries could have been a little better, specially the morning session one. I could have waited for a clearer sign that support was broken, as I did the second time around when I sold more spreads.

Tuesday April 23, 2024:

Today trading resulted in a loss of almost $5K. I executed my trades based on my gameplan from yesterday. Based on the price action I originally sold bull put spreads on NQ but then looking at the RSI and the fact that we’re in the middle of a bounce after an extraordinarily large drop made me change my mind and execute my prior day’s game plan of selling bear call spreads. I executed my entry a little early, so although the area I sold at did end up being a resistance where price fought for a while, I sold too early at low prices. I stuck to my plan of exiting my position at a loss once a breakout pattern was formed. I am happy with my exit trade but for the future I can improve my entries when in between levels.

Going into tomorrow, the market seems overextended from this bounce. The 1 hour and 15 min charts on NQ are both oversold on the RSI and the 1 day chart is about to clash against the RSI trend line. The NDX is about $200 off from its 9 day MA and the NQ is like $15 to $20 off its MA. NVDA is also right at its $840 resistance and at its MA. META has retaken its MAs, and TSLA had in pre-market bounced quite above its resistance. TSLA reported larger revenue and profit drops then anticipated but moved up its timeline of when it would begin selling its cheaper EV alternative and also mentioned its expansion into AI products. This pushed the market up significantly after hours and drove NVDA up around 2%. MSFT has approximately the same technicals as NQ. META and IBM report earnings tomorrow after hours. If the market is able to push above its MA and hold above its $17800 resistance tomorrow, then this might be a real market bounce. If this is a dead cat bounce, tomorrow is likely to be a time when a drop begins. For this reason I have sold 6 bear call spreads and will look to sell more if NQ approaches the $17800 resistance.

Lesson:

When in between levels I should wait for the price to get closer to/touch the resistance/support level before selling the spreads I want to sell. This will allow me to execute at a better price and sell at strikes with some breathing room away from the level.

Monday April 22, 2024:

Trading went well today and I executed both entries and exits very well. I held some bull put spreads overnight on Sunday anticipating a relief rally premarket. This worked out in my favor and I was able to sell them at a profit at the market open. I also closed out the NVDA call spreads I had bought on Friday at a $1K profit. I could have held longer but decided I didn’t want to risk losing my capital on an out of strategy trade. All though I was intending to only sell put spreads, the early part of the trading session seemed to be creating more likelihood for a pull back then for a large bounce from the levels the market opened at, so I sold some call spreads which I closed out once the market moved lower. I was then able to execute my pre-planned strategy from last night to purchase the bull put spreads below the support level I wanted and was able to again profit nicely from these. I executed on increasing my position size but today also sold when reasonable profits were achieved as opposed to the 3 candle high/low rule that was stipulated from yesterday. Given the lower liquidity and higher volatility in the market, I think tightening profit taking makes sense and is why I executed my exits in this way.

Saturday April 20, 2024:

I executed my trading plan as planned on Friday in terms of entries and target support areas. The market however, completely went against me and as I saw clear signs that the market had turned old supports into resistance areas, I ignored the technicals and held onto my belief that the market was bound to bounce. I could have gotten out at $2K down, $4k down, $6k down and $8k down but stubbornly held on and ended up taking a loss of $12K.

Going into Monday most of the big NQ stocks are just below key support areas (now resistance) and the NQ and NDX are trading slightly above a very key area which is the breakout region of the previous swing high. MSFT, TSLA and META are all reporting earnings this coming week, all which are more likely to provide clarity into the growth of AI and could be either a positive catalyst for the market and NVDA to bounce from the key area its at or a negative catalyst to drive the market into a bear market. Based on how recent Q4 earnings were and the fact that TSM signaled continued strong growth in AI market chips, I think it’s likely these earnings serve as a catalyst to drive the market and NVDA higher. The market could also be simply discounting prices to compensate for higher for longer rates and it’s possible even positive earnings don’t positively impact the market.

Since the drop last week was very large and all key stocks and markets are near key support areas, I think it’s likely we got some form of bounce on Monday. I think it’s also possible to see a strong follow through from Friday’s sell off, followed by a larger bounce later in the week.

Going into Monday I will be looking to primarily sell bull put spreads at the $17160 level and will not likely engage in any bear spreads. There are no scheduled reports for Monday so there are no specific restrictions on trading early. Based on the last few days, if I do enter a position pre-market, a large negative 5 min candle on open might be a sign that the selling will resume.

Lessons:

Observation 1: Based on this experience as well as prior days where I’ve max lost, I need to develop a clear and definitive strategy for exiting losing trades on the first signs that they might be a losing trade. There are 2 patterns that I’ve seen multiple times now that signals that a level will not be held – drawn below:

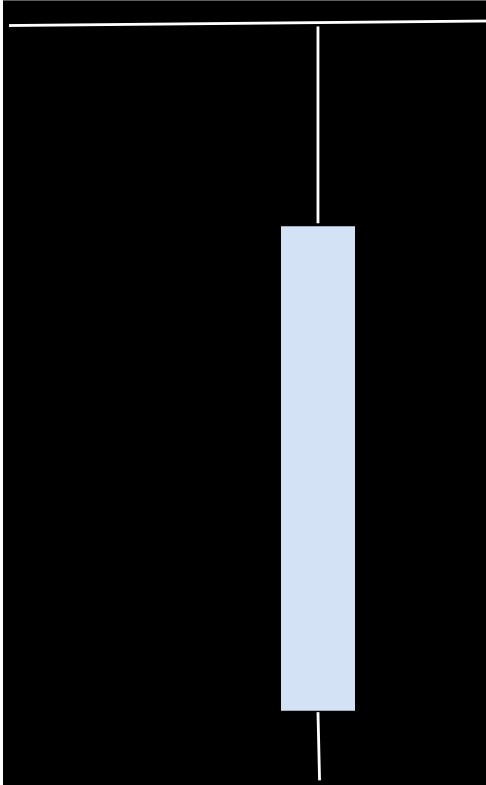

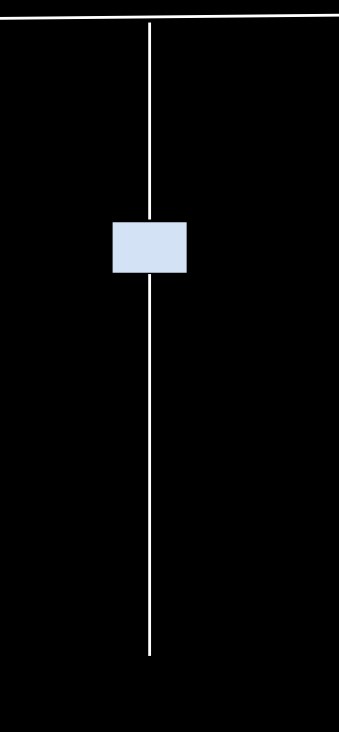

Pattern 1 – Broken Support: Bearish 15 minute candle of this shape forms below a level that was previously identified as support. If instead this same candle formed but in a bullish manner above a level that was previously identified as resistance, then it would signal a broken resistance

Pattern 2 – Broken Support: Bearish 15 minute candle of this shape forms below a level that was previously identified as support. If instead this same candle formed but in a bullish manner above a level that was previously identified as resistance, then it would signal a broken resistance

Normally after a candle like the 2 above when a support has been broken, signal that they’ve been actually broken and that the market is going to continue moving in that direction. When I see either of these patterns in the future, if I have a bullish put spread open, this will be my trigger to exit. Also if I see 2 15-minute candles that both close below a support then I have to close my position even if it’s at a loss.

Based on this premise I can start to take more exposure risk and also make larger wins when I’m correct.

Observation 2: During periods of rising volatility, as measured by my daily volatility analysis, intraday reversal of trends are common and therefore profits need to be taken in a more rules based manner. The criteria for taking profits that will be used for now is the earlier of the 2 below:

- upon a 15 minute candle making a 3 candle low/high, as long as the candle is not a spring/thrust candle, or a candle that clearly demonstrates a holding of a key level.

- When a key resistance level (on bull trades) or a key support level (on bear trades) is reached.

This rule will be tried at all periods for the time being, but is crucial during rising volatility.

So far my entry decisions don’t seem to need that much tweaking so I won’t change anything for the time being. Only change will be to up the trade sizes to $5K-$6K max loss for starter positions and $10k-$12k for full risk positions.

Thursday April 18, 2024:

Today was a good trading day. I was able to make the trades that I had outlined below. I ended making some losing trades as the market bounced hard after the initial drop. I however was able to exit my position at a loss I was comfortable with and switch to selling bull put spreads before the full extent of the morning recovery. Given that a further drop was also probable, I decided to close out my positions at a decent gain. The market did eventually tumble again and would have threatened my positions had I not closed early.

Going into tomorrow the NDX is about $60 away from a key support, while NQ is about $70 away from a key support. AAPL is trading almost at the previous swing low, MSFT broke through its first support mentioned yesterday and is about $2 away from its second support. NVDA had a spring today off its $825 support and is now trading above its $845 support. TSLA is trading near potential support and META is still about 8% away from support. All stocks continue to trade below their MAs. My 3 day Volatility MA just crossed the 5 day volatility MA and is now significantly below the 5 day MA. In the past this has been a signal that Volatility is coming down. Today another FOMC member said that while rate hikes are not the base case, they would be willing to do them if necessary. This sent the 10 year yields back up to a similar price as yesterday. Given that this week has been a strong down week and that the market and various stocks are at or very closely approaching their support areas, I think that it is very likely that the support line is held and that we get a small bounce. Specially given that generally speaking, TSM’s and NFLX’s earnings reports were good even though the market has punished both stocks after the release of their earnings. Pending any developments from Israel or any other interest rate related shocks, I will be looking to sell bull put spreads at the $17470 support line in NQ. I might consider selling and holding some overnight as there are no economic reports due tomorrow and I believe an overnight bounce is likely.

Wednesday April 17, 2024:

Trading went well today. My execution again was really good. Again I waited until close to the market open before opening up any positions. I was able to sell some bear call spreads that were far away from the market price and able to quickly close them on the market’s initial drop. Because Monday’s drop was large and the market was still trading near the $17800 support area, I knew that a small bounce was a possibility so I waited for a few minutes to see more price action before opening up my biggest position of the day. Once I saw that a key support in the NDX had been broken convincingly, I began building bear call spread positions above the area where the large drop below the support had began. The market dropped a short while after and I was able to close my position at a large gain. I didn’t hold it any longer because of how close my position was to the market price, and how close the market was to a support area, so it could reversed and climbed back up.

Going into tomorrow the NDX closed the day between a resistance and support area. The price is $200 off the resistance and about $165 off the support area. NQ also closed between 2 levels but much closer to the resistance then the support. AAPL is approaching its swing low that it had bounced from last week, NVDA is approaching the support it had bounced from last week, MSFT is below its bull channel and approaching a support about 2% away from its current price. Meta also dropped and is about 8% off its support level. All key stocks are also below their MAs. Oil dropped more then 3% today, likely due to a new detail that Israel is planning to attack after April 30th and that it might limit the scope of its attack, and possibly from higher rates maybe reducing trader’s expectations of future economic growth. Tomorrow TSM reports earnings before the bell and NFLX after the bell. Given that TSM’s chips are the drivers of the AI revolution, their report will be of significant importance in tomorrow’s session. There are a couple of economic reports at 8:30 AM, so no trading can be done prior to this. If these reports cause rates to drop, that could be a potential catalyst for a larger rebound tomorrow. Barring an excellent TSM report or really low inflationary economic reports, I think the market is most likely to trade in a range between the resistance and support that it’s currently in between. A move below the support is unlikely given the size of the last 3 down moves and a move above the resistance is unlikely given high interest rates and the middle east risk. That being said a large rebound higher is more likely then a follow through drop, UNLESS TSM’s report is particularly disappointing.

For tomorrow I will be watching TSM’s report, and price action after the 8:30 AM reports and looking to sell call spreads above the resistance line at $17800 and looking to sell puts at the $17470 support if possible. If TSM’s report is very positive I might lean more towards selling puts then calls. Gold had a red day, which might be a short term signal that a rebound is looming.

Tuesday April 16, 2024:

Trading went well today. I entered the day very cautiously as there was potential for both a move up on the bounce or continued downside due to headlines and technicals. I waited till after the market had opened to take a position. The jerkiness back and forth was hard to gauge but the market structure made $17800 look like a good support for the day, so I took an opportunity at around 11 AM to sell some bull put spreads at the next support level of $17700. The market moved up soon after and I was able to close the day at a good profit, making half of my profits from some early trades I closed fairly quickly and the other half from the $17700 put spreads I sold.

Going into tomorrow, the technicals for Nasdaq stocks are still pointing towards more potential for large downside then large upside. Today AAPL crossed back below its MAs, TSLA slid close toward a previous swing low, MSFT remains below its bull channel and MAs, NFLX is also just below its MAs and META is also below its MAs. Powell made comments today suggesting that the FED might have to hold off longer on cutting rates as inflation has not continued to decline as last year’s data was suggesting. 10 year yields however did not respond too sharply. This could be received both negatively and positively since the market might had hoped that he would provide relief to the markets that are being affected by geopolitics with some chatter around rate cuts coming more quickly. Since he didn’t, it could also signal to the market that the fed does not view the Israel/Iran tensions as very serious. Gold also continued to make a new ATH today and Oil traded slightly lower. Given high yields and continued risk from Israel, I will be looking to sell bear call spreads around the $18170 level and cautiously sell bull put spreads again around the $17700 level if the market provides a good opportunity and the $17800 continues to hold as a strong support area. Tomorrow might be a tight range day, specially if no new headlines related to Israel occur. This might be a good opportunity to sell spreads on both sides. A good headline scan needs to be done in the morning. Given the uncertainty its preferable to start trading at or after market open.

Monday April 15, 2024:

Trading went well today, with my execution being close to optimal. In the morning the market opened almost 1% up, ignoring the fact that Israel had gotten hit by Iran and that it had said it would retaliate. This also came after TSLA cut 10% of its workforce and Apple’s iPhone sales dropped by 10%. I sold calls at the levels I wanted to the day prior and also sold some more aggressive smaller spread calls as I was anticipating a drop at open, both from the conflict abroad and that rates shot up after better than expected retail numbers. One of the call spreads I sold were in the money prior to market open, so I sold those at breakeven the moment the market dropped at open and kept my other less risky spreads until I was able to close them at a good profit. I then bought some deep out of the money debit bear put spreads, knowing that there is still large amount of negative headline risk about when and how Israel might attack, and that rates had shot up. The market went from 1% up to close almost 2% down and my out of the money debit put spreads made large returns with some making a 24X ROI.

Going into tomorrow, only AAPL is above both MAs and Google is above the 21 day but below the 9 day. All other big NQ stocks are below their MAs and not near a clear resistance, even MSFT finally broke down from its bullish channel. The market however is trading right at a support level. Given today’s large move, normally a small bounce is expected, but given the technical position of the big NQ stocks, and that no NQ stocks are reporting earnings tomorrow or no other pre-market announcements are expected, the market might not bounce, and in my opinion is not likely to hold a bounce. I will be looking to sell calls at the $18170 level if possible and if not cautiously sell calls at the $18060 which is the bottom level of the range that the market broke down from today. If the market shows some stability, I might again buy some bear put spreads for a later day breakdown. Headline risk to the upside is limited but could come in the form of Israel toning down their talk or FED saying they would consider cutting rates due to geopolitical risks. Powell speaks at 1:30 pm, so outside of debit spreads, its preferable to be fully closed out by then. Gold is also again at ATH with oil also rising today, confirming the negative technical patterns building in the market. Caution should be taken tomorrow as jerkiness is likely and a possible attempt to retake the broken range might occur. I will wait until as close as possible to market open tomorrow to get more info before initiating positions.

Friday April 12, 2024:

Profit-wise the day did not go well, and execution on entry of my positions was poor. From the prior day’s journal I was anticipating that a pull back was likely and that the market would trade in a tight range. I had mentioned that earnings from JPM would be an important driver for the market. JPM’s stock began to tumble after it’s release and the market was moving downwards in the pre-market. I decided to sell bull put spreads since I was not expecting a large pull back. The area I sold puts at was a weak level and I was in the money prior to the market opening. The volatility expectations I have are not inclusive of pre-market and had I waited till market open I would have likely been able to sell at a better level and not experienced as large of a loss as I did. Going forward if I’m trading counter-trend, I will wait till much closer to the market open to enter my position. That being said I managed my losing position well by transitioning down to a stronger level of put spreads when the market dipped further and exiting the new position when the market rebounded. This helped me limit my losses to $4K as opposed the 9k+ losses I would have incurred from my original spreads had I held them to close. I think part of what drove me to trade so early in the morning was trying to make up money for the losses Incurred on Thursday afternoon. I have to remember the goal of my trading is to validate my strategy of trading spreads up until 11 AM. If I can validate that, money will eventually be made.

The market dipped heavily on Friday, likely on the rumor that Iran would strike Israel over the weekend. The market finished right at the bottom of the inside range that it’s been trading between ($18170, $18500). The market has been in this range as it weighs the pros of the AI revolution and growing tech earnings, and the increasing probabilities of little to no rate cuts this year, higher inflation and increased tensions in the middle east. The market and NQ are both now trading significantly below the bullish channel and below their MAs. Gold continues to trade near ATH and oil seems unaffected by the Iranian attack. The market is likely pricing in either no retaliation or a very minor retaliation by Isreal. If the retaliation by Israel is significant, the market will likely react very negatively. This means that the week ahead is likely to be full of headline risks and jerky market movements as new developments hit the media headlines. Given that even a diplomatic resolution between Iran and Isreal still doesn’t solve rising inflation, higher interest rates and any earnings disappointments, I think it is far less likely the market experiences a significant jump this week and it is likely we see big red days at some point this week. Aside from these risks, earnings will also impact the market significantly, GS reports Monday prior to market open and is likely to be a big driver of the trading day, along with any developments from Israel. In this environment, trading reversals off of the extremes of the range is likely to be the best strategy. Risk should be limited when we are in the middle of the range, and preference should be taken towards bear call spread selling, given the increased downside risks.

On Monday I will look to sell bear call spreads around the $18500 area if possible, and cautiously sell bull put spreads around the $18060 area, as well as buy debit spreads if implied volatility drops. selling bear call spreads with the short strike at $18420 is also decently attractive as that is a minor level and is right at the support line of the bullish channel. If Monday ends up being a day where I am making a contrarian entry, I will do it closer to or after the market opens. If I see a big rip in the morning, I might look to be buy some debit put spreads.

Apple’s drop in global phone market share might weigh it’s share price down as it is already in a downtrend and might add selling pressure to the market

Thursday April 11, 2024:

Trading went okay today. I traded very well in the morning session, sticking to my plan to sell puts near the $18170 area. I started my position after the PPI report was released and the reaction was positive, clearly clearing the $18170 support. As the morning session developed I took some profits on some of the bull put spreads and increased my contract sizes significantly when the market retested the $18170 support in the morning. I was able to close the contracts out at good prices and closed the morning session with profits of $1,855. In the afternoon the market ripped higher clearing the $18320 resistance, clearing the support for the long term bull channel and reaching the $18,420 resistance area I had marked out for the range the market was trading in. I sold some bear call spreads with a short strike at $18460 and quickly closed them for a $200 profit. The market kept going higher and as it approached the $18460 level, I sold some more bear call spreads with a short strike of $18490. Going on levels alone the trade seems like good risk/reward, but when you consider that I am opening a position only $30 away from the market and that liquidation is a real danger at this time, this is not a trade I should have taken. Going forward I will stick to my pre-11 AM trading strategy. That being said, the day was still really positive as I was able to make a $760+ profit.

The markets moved higher, likely from a combination of a better than expected PPI report and a possible change in mindset that pushing rate cuts out might also mean the economy is really strong. If this is true, traders will likely care a lot about the earnings reports coming up in the next few weeks. JPM reports tomorrow, and will likely be an important factor in tomorrow’s session. Going into tomorrow, NDX is touching the entry into the long-term bull channel and NQ broke through 3-4 resistance levels and is now back within the uptrend channel and only $200 or so away from ATH. NVDA also regained its long term uptrend channel and is trading above its MAs again. TSLA is also above its MAs and APPL had a 4%+ move. NVDA is near a 15 min resistance, NDX is right at the channel support and NQ is right at a resistance at $18500 and close to a $18600 resistance. Gold also continued its bullish run today and interest rates jumped to above 4.5%. Given that the general interest rate news has been negative, and that the jump today was very large, and stopped right at key levels, I think a small move up or a small correction down is the most likely scenario. Unless today’s move is simply late bull cycle jitters, a large move down is probably unlikely, with a large move up a possibility.

For tomorrow the plan will be to watch the markets reaction to JPM’s earnings and try to sell calls at around the $18600/$18700 levels.

Initiating trades after 11 AM is absolutely forbidden going forward. In order to cut out the temptation to make trades later in the day, Stocktwits is off limits after my morning trading is completed and the market chart can only be checked once at 2 pm and once at 4 PM. IBKR can’t be opened for the rest of the trading day as well. Obviously once the trading day is finished everything can be looked at in order to create a trading plan for the following day.

Lessons:

- Don’t trade after 11 AM

- Take actions that will stop you from being tempted to trade after 11 AM (No checking StockTwits after 11 AM, no checking charts or market prices except for once at 2 pm and once at 4 pm, and not opening my brokerage app after 11 AM)

Wednesday April 10, 2024:

Trading went well today and I was able to execute much better on my trades. The CPI report came in hotter then expected and the market crashed hard right after the release. The market hit the $18060 support and when it did I sold some bull put spreads below that area right as the velocity of the move down was decelerating and the market had shown signs of bouncing off of that level. I then sold some more bull put spreads at the $18060 level and end up being able to close all my positions by around 10:10 AM after the market’s initial move up. The market could have taken out those levels later on since it had rejected VWAP a couple of times. It eventually did not do that but I am happy I exited when I did as holding would have not been worth the risk given the negative report and the strong move down right after the report was released.

The market seems to be very resilient even with increasing rates, and increasing likelihood of fewer or no rate cuts. The Fed’s meeting notes were also released today, the Fed stated they need to see more progress on inflation and that a long discussion was had surrounding inflation and the dangers of cutting rates. The 2 possibilities are that the market is holding back the full extent of the move and a larger dive will occur in the next few days or that the market is happier about the economic growth and upcoming earnings then what it cares about rate cuts. The Nasdaq continues to trade in the range identified earlier. NVDA recovered most of its loss from the day prior and is now very close to its long term support channel. AAPL dropped but is still above the swing low of $165. TSLA dropped back below its MAs. MSFT continues to trade in a bullish uptrend channel. The NDX officially had a bearish MA cross over today and the NQ remains below its MAs.

Given that NVDA was the most likely candidate to bring the market down since it was the main company that brought it up and it has already almost recovered its long term support, and the fact that the market was not able to crack the support of $18060 when it tested earlier this week after Kashkari’s comments, leads me to lean more on the theory that we will either be range bound between $18060 and $18420 or that we will break out to ATHs soon. I see a bigger probability that we have a very strong up move then that we have a strong down move,. This is because a lot of the markets selling energy have been sucked out. For this reason I will be looking to sell bull put spreads with a short strike near the $18060 mark and also sell bear call spreads near the $18420 mark. I might also add some debit call spreads if I can get a good price. Trading prior to the PPI report at 8:30 AM tomorrow is a no go. If the reaction to the report is strong I will likely take the reversal trade. To do this I will wait for a clear reversal pattern and for price to come very close to my identified levels. If the price action looks very strong to the upside or downside I might wait till closer to the market open to make a decision.

Tuesday April 9, 2024:

Trading went well today. I executed my plan from yesterday in the morning. I waited until open to open my position and I was able to sell the spreads for a good credit and close out without too much suffering. The break in long-term support I was monitoring on NVDA happened and the market was dragged significantly lower to right around the $18177 support of the range the market has been trading in. Seeing this drop and knowing that the market is waiting for the CPI numbers on Wednesday, I sold some bull put spreads pre-maturely at a crappy intraday support at $18250. The market traded right through that weak support and hit my $18177 support. I sold a lot more bull put spreads at this level but prior to the full down move and was not able to get a great execution price. The market did however bounce and I was able to close my second spreads at a large profit and the $18,250s at a decent loss, netting out a $500 profit between the two. My execution has been my biggest flaw in trading. The game plan I create is normally close to spot on but I often let my fomo get me in trouble. If I’m trading a counter-trend I have to wait for a clear sign of a reversal or until a strong support is reached. My early execution has hurt me many times so I need to adjust this. Also, using weak intraday levels has hurt me more than it has helped me so I have to stop using those to make decisions.

Going into tomorrow NVDA seems to have bounced off of its $830 support and is within $25-$30 of recovering its long term support. Apple is still near its swing lows and Meta is still in a breakout. TSLA seems to potentially be reversing from its down move, and is now trading above its MAs. NQ recovered its long term support line after testing its $18177 range support. The day ended off as a large red hammer spring candle which might be a predecessor to a large jump to the upside back into the middle of the upward channel and potentially setting up a break of ATHs if tomorrow’s CPI report comes in better than expected. Based on NVDA having had a lot of selling energy sucked out today and considering it is the individual stock most likely to bring down the market, and given NQ’s strong rejection of the support, I think tomorrow is more likely to be an up day, with a good likelihood of being a more than 1% up day. I will look to sell puts around the $18177 support if possible closely after the release of the CPI report. If those puts don’t offer a good premium I will consider selling puts at the support of the bullish channel. If the report is negative and the market makes a strong move lower than selling bear call spreads at around $18320 might be the play tomorrow. Absolutely no trading to be done prior to the report release at 8:30 AM.

Monday, April 8, 2024:

Trading went okay today. My bear call spreads made decent profits but most of the profits were offset by the debit bear put spreads that I bought. I think the amount of debit spreads I bought was a bit excessive at $700 CAD, and also at a time when a spike in realized volatility had just occurred. From what I’ve seen, large moves tend to happen when both the 5 day and 3 day volatility MAs slip below $50. These should be the days when I should be using the debit spread strategy.

Right now it seems like the market is really testing the Long-term support line on the Nasdaq futures although the spot Nasdaq market did not make any contact with the support line today. CPI data comes out on Wednesday and it’s likely the market will be in a tight range until that data comes out. The chart is not providing any clear opportunities leading into tomorrow and my instinct says we’ll be range bound between $18420 and $18177 until Wednesday’s data release. NVDA however is hovering at its long term support line again as at the end of the day and APPL at its low of its most recent downturn. These 2 could create the catalyst to lead the market lower. The 9 and 21 day MAs on the NQ officially completed a bearish crossover as well. A small move higher is what my instinct says is likely but a large move higher seems unlikely. Waiting for a move higher tomorrow might be the best way to trade tomorrow, selling bear call spreads once I detect a reversal to the downside, assuming a close below $18420 is what’s most likely.

Conclusion: I likely won’t trade anything prior to market open unless price action overnight is significant, and I will wait till a move higher in order to sell some calls above $18420

Sunday April 7, 2024:

My trading on Friday went well. The market had closed the day at a support line that had supported the market’s last 3 weekly candles. Given the strength of the down move on Thursday from 2 PM to close, I felt a bounce was likely given the support area and how large the down move was. I was also looking to sell calls around $18320 as this was slightly above the long term support that was broken with strength on Thursday. I didn’t think that the market would be able to recover that level on the next trading day after it had been broken it that strongly. On Friday morning I waited for the jobs report to come out to see the reaction of the market. The first 15 min candle after the report was a large downward move that ended with a bullish hammer candle. This candle touched the support line from the prior day and rejected it strongly. After this point I began selling put spreads under this level. In the morning session the market rallied and I closed out my position. The job report was positive as a lot of jobs were added in March but it also reduced the expectations for rate cuts. Later in the day the market kept rallying and I sold bear call spreads with short stirkes at $18320 and later at $18400, I was at a large loss until the rally consolidated and I was able to close out my second set of calls at a good profit and my first set of calls at a small loss.

Given that the market has rallied on the back of strong AI related earnings and an increased expectation for rate cuts, it is a bit ambiguous whether the strength of the job report will be truly well received by the market as it might point to continued earnings strength, with earnings season approaching shortly. That being said the Nasdaq futures are approaching a bearish MA crossover likely by tomorrow, with the spot Nasdaq almost there too. NVDA had a bounce off its long term support line but it is also approaching a bearish MA crossover. AAPL is in a bearish trend and so is TSLA. META is at all time highs. Gold also made a new ATH on Friday. Another piece of info is that NDX closed below its long term support and NQ closed right at it. The tide seems to have shifted in a more bearish manner, but a consolidation is also likely until earnings growth changes. A consolidation below $18420 and above $18060 is likely until we get more rate cute/earnings developments. Monday is the end of a technical triangle so a large move is also possible and I’d favor a downside move more than an upside given the recency of the interest rate comments made by the FED.

For tomorrow I will be primarily looking to sell call spreads above $18420, and possibly add a slither of debit bear put spreads. Bull put spreads seem a little riskier at the moment, so I might avoid those for now.

Thursday April 4, 2024:

Trading today went well, although my execution was sloppy. I wanted to get myself a little bit ahead of the economic report today so I started building my bear call spread position prior to the report. My logic was that I wanted to have a big day in order to get back to my winning ways, so a bit of aggression was warranted in my mind as a way to get my confidence back. The day started off poorly as I was already at a big loss prior to markets opening. I decided to hold on to my positions and added a few more spreads throughout the day. Then at 2 PM, an FOMC member said that rate cuts might not be necessary in 2024. The market reacted very strongly to this, moving the markets from up 1% to down 1.5%. This type of move is really strong, especially given that it closed the day almost at the low of the day and way below the long term support line. The rising channel seems to be clearly broken, the task now is to decipher whether we are now in a downtrend or if we are going into consolidation. NQ is currently at a weekly support and there could possibly be a horizontal channel between $18,620 and $18,060. The evidence that would point to a down trend is that the moving averages for NVDA, and AAPL have now made bearish crossovers and both are trading below their 9 and 21 day MAs. The market is now also below its MAs and the bearish cross is about to happen. Given how strong the move was today and that market participants are probably convinced it was due to one man’s comments, I think tomorrow could see a small bounce and the $18060 support could hold. I don’t think there is a strong chance of the $18360 or $18320 resistance levels being retaken, and especially not if NQ breaks $18060 decisively. Pending market action I think selling bear call spreads around $18320 and bull put spreads below $18060 could present good opportunities tomorrow.

Wednesday April 3, 2024:

Today’s trading started off well with me selling bear call spreads to play the downtrend. Once the market approached the long term support line, I sold bull put spreads around that area. Within the first 30 mins of the market being opened, it seemed that the market was going to continue the downtrend so I switched sides and started selling bear call spreads. Then at 10 AM the ISM numbers were released, this had gone under my nose. At this time the market ripped higher, the move was strong and clear and out of a support area, this should have been my cue to close my position. However I decided to hold on as I felt the original reason for the selloff (high wage growth, continued rise of 10 Y yields) was still there. Powell spoke at 12:10 PM and re-affirmed waiting for more data before cutting rates and that there was no rush to do so, but also added that the current data, although higher then expected, did not materially change the broader outlook. The market held higher and I eventually closed my position at less then max loss, before the market eventually did go my way. The only action I think I took incorrectly today was not having reacted to the $70 dollar 1 minute bar at 10 AM. This was a clear change of market structure. Almost regardless of the reason, that move within the context of the fact that the market was just at a long-term support line should have been enough reason to change my mind.

Tuesday April 2, 2024:

Trading based on the strategy went well today. In the morning the market was very bearish and broke cleanly through the $18420 and $18360 support lines. Given these clean breaks and all of the other bearish signs I had outlined in yesterday’s entry, I sold bear call spreads all morning and had my best trading day since starting again. Today the market gapped lower and touched the lower long term trendline, it hovered there before closing up around 100 points higher than the lows. The news that likely drove the move was Tesla’s low delivery numbers as well as the spike in treasury yields. Gold continued to rally to ATHs and Bitcoin continued to crash. NVDA hovered near its lower long term trendline before bouncing, but it still has not reclaimed its MAs. Given that the move today was likely a combination of the TSLA news, rising yields and a market overextension as it appears on the weekly chart, it is very possible we break the lower trendline tomorrow. A continuation of the bounce off the trendline above the $18360 level would be somewhat unlikely, above $18420 unlikely and above $18460 very unlikely. These are levels I will look to sell calls at depending on the market’s price action. I will be a bit more hesitant to sell bull put spreads given the larger downside risk, but put spreads with a short strike around the $18,250 level might be a good play if the market looks like it is bouncing off the trendline.

Monday April 1, 2024:

Trading went well today as the NQ remained within the tight range that was outlined before. The market made 2 attempts at breaking out of the triangle but both times came back to the range. One attempt was also made below the $18460 support but it was quickly recovered. I think tomorrow we will likely get a direction established outside of the tight range. Based on NDX’s chart it seems their is more chance of a bullish move than a bearish move in the short term but we are also really close to breaking out of the long-term range from the support line. This means a break to the downside will likely have more strength then a break to the upside. Bitcoin failed to breakout to ATHs, Trump’s company dropped today and Nvidia failed to recover its 9 day SMA. These might be subtle signs that the strength required to push markets to ATH might be wanning, at least likely for this week. Interest rates also jumped today based on comments Powell made on Friday and Gold is continuing its ATH run. Given the short term term bullishness, I will sell bull Put spreads below $15420 if I can get a good price, and sell bear call spreads near or above $15700 if I get the chance. If $15360 is broken though, then there might be a good chance we go all the way to the lower purple line in my graphs.

Sunday March 31, 2024:

Going into next week, the market looks like it could retest a break-out at some point earlyish next week. The core CPE numbers that were reported on Friday for February came in lower than expected, likely increasing the chances of a fed rate cut. This mixed with the tightening range around market ATHs and the fact that the SP500 hit an ATH on Thursday, increases the likelihood of a short-term break above ATH for NQ. I’m not convinced of a large breakout, given the pattern on the weekly chart. So I will need to be careful to not overexpose on bull put spreads if the market does break ATH as it might be a short lived excursion into new prices. If IV remains low on Monday and Tuesday, buying debit spreads might be better.

The NQ is trading bullishly in the premarket on Sunday and is trading above the line from the triangle that was forming on the tightening range. This coming week there is likely to be traders on holiday and off for Easter Monday. Although the pre-market move seems bullish, I don’t think Monday will have enough volume to push NQ through to ATH. For this reason I would be looking to sell some bear call spreads outside of the $18700 area if the market moves somewhere close to that. Otherwise I also don’t believe we’ll push back below $18460, and incredibly unlikely below $18420, so I would be looking to sell some bull put spreads if I can get good prices at those levels.

Thursday March 28th, 2024:

My first 2 days back at trading went well. On the first day I was able to sell bear call spreads right before the market opened as the market was approaching a resistance line. The market sold off and I was able to close my call spreads at a good profit. I then proceeded to sell bull put spreads at a support line that I had identified. The market traded through the support but was staying near it. To protect myself I closed the put spreads I sold at this support for a loss and sold some more bull put spreads at a lower support. Once we got a bounce I was able to make a decent profit on the second round of put spreads and close the day off at approximately 5% return to max loss exposure. The market eventually reclaimed that support line and closed the day off with a large upswing. The market had been closing on downswings the prior days, so this leads me to believe there might be some slight structural changes occurring.

For March 27th, I went in thinking that the market might be in a tight range given that it was a day before a long weekend. I had a bit more of a bullish bias given the previous day’s action into the close and the strength with which the market had reclaimed the $18420 support. Going into Thursday I was looking to sell bull put spreads at that $18420 support that had been protected the day prior. I was a bit hesitant to sell bear call spreads, given that the range of trading is starting to tighten close to ATHs. The trading day started with a market drop which I used to scale in my bullish spread positions and proceeded to close over the next hour and a half as the market climbed back up. The market had some up and downswings in between which I used to book some profits and then re-expand my position. Overall the day went really well and I closed the day up around 15% of my max loss exposed.

Tuesday March 26th, 2024:

I am going to begin trading again tomorrow. I took a week pause to process my losses from the prior weeks, to redefine what my edge is and to relearn some technical analysis concepts. During my reflection period I determined my edge was 3 fold:

1. I profit from range markets (this is an advantage as most traders avoid these markets

2. I use an instrument that profits as long as I’m not very wrong, instead of profiting if I am correct.

3. I use my understanding of the markets, and economic drivers in order to compliment my technical analysis.

Going forward I will never risk more than 25% of my portfolio on a given day. This will allow me to truly discern if I have an edge or not and not simply blow up my account from a few unlucky movements. I will also use my intraday read of the markets in order to exit trades early that I think might become losers. Before I make a trade I will have a clear understanding of why I am making it and use that to guide when I should be exiting a trade.

Analysis of markets:

From a technical perspective, the NDX is trading with different trends on the 15 min, 1 day and 1 week time frames. On the shorter time frame the market rejected a push through all time highs and retreated slightly after crossing all time highs. Price is now trading in a 250-300 range under the all time highs. The market made lower highs and higher lows on the 15 min chart and is resting at a support. The 1 day time frame is in a rising trend channel and has been trading in the upper band of the kelter channels for a while. It’s last push to ATH came on declining momentum based on the MACD level. On the one week chart the market looks a bit toppy, as its last 4 candles have been trading in a range at the ATH levels with lots of candles mainly outside the kelter channels. NVDA also recently fell off its ATH and made a push to that region, falling short and coming down 2% today. Apple has lost 33% of its market share relative to February of last year. The push through to highs came on the back of the FED repeating what they’ve been saying all along but reducing their forecast for 2025 rate cuts. Markets seem to have responded bullishly as they were likely beginning to think the FED might not cut given the increase in CPI numbers.

The key news items that could help the markets push through all time highs or below the lower range of the channel would be unexpected inflation numbers, strong change of positioning from FED, more companies losing significant sales due to the situation with China, chip stocks entering bearish trends, or worse than expected results from chip stocks.

Based on the toppy look of the weekly time frame and the fact that we just saw a leg up, I think there is more risk of an outsized down move on no news then of an outsized up move on no news.

Right now might be a good environment to sell option spreads on both sides, with discretion based on changing trends and news cycle.

For tomorrow I’d be looking to sell bull NQ put spreads with short strikes at the $18360 level and bear call spreads at the $18700 level. 5 day MA of volatility is $100 and 3 day MA is $67

Thursday March 14th, 2024:

On the week of March 4th I went on a 4 day losing streak. It all started on March 5th, a day where I was on the losing side of a trade almost from the market open. I felt I was on the wrong side and in order to not hurt my PNL numbers I left my trade on, hoping the market would recover and ignoring my levels and gut feeling that I was on the wrong side of the trade. On this day I could have closed down $6K but instead I ended up losing $15.65K. The next day I began the day trading well and made a profit of $1.75K quickly, still having the previous day on my mind and wanting to make back my losses, I kept trading at random levels in the hopes of extracting more profits from the day. The day then turned on me and again I closed the day down a lot, this time losing $7.5K. The next 2 days went similarly with me choosing the wrong side of the market and losing another $3.5K on each day. I took a pause on the Monday that followed in order to see if any of my trading strategies had to be adjusted. I determined the only common denominator of the days I lost money was that the market on the previous days had made open to close moves that were much larger than was normal on prior days and that the moves were pretty one directional with not many fake bounces. Based on this I created a volatility Moving average to tell me when markets were trading with rising volatility vs falling volatility, as an ideal environment for me is falling volatility. Based on this I decided to trade only in flat and falling volatility environments. I also wanted to ensure that I was selling at least 1.5 3-day avg volatility units away from the open, in order to give myself more cushion. I also realized that most of my winning trades would go on to expire completely worthless and had I held every trade to expiration I would have made an extra $59K. This analysis however does not take into account that at around 3:30PM, IBKR sells my positions if they are in the money or close to in the money. This is an added layer that could possibly materially change my analysis results. In my first 3 days of trading based on these rules I had 2 profitable days and 1 losing day. The new rules force me to always trade against the direction that the market has gone. This is sometimes uncomfortable when I am in agreement with the market’s initial direction.

What has worked in the past for me is trading in the direction that makes sense given the day’s news cycle, the short term trend of the big stocks driving market moves and interest rates. Using technical analysis I could determine levels where even if the market initially went against me, it should turn given that there wasn’t strong news to push it through the levels. Mid-term, and long-term trends were also used to determine what side of the market I’d take. The strategy was based on the safety of knowing that I didn’t have to predict where the market was going to go, just where it was unlikely to go. It is very possible that I got too in my head after the loss on March 5th, as that loss came from a day with a large move down even though there was no significant news to explain it. In prior trading on days where I was unsure I would only take trades that were really far out of the money and would close for small profits or small losses as I was unsure. I believe that these methods got me to where I was and whatever adjustments I make to the strategy must keep these methods untouched.

Lessons:

- Don’t hold on to losing trades solely out of hope

- Don’t carry yesterday’s PNL into tomorrow’s trading, every day is an independent trading day

Sunday March 10th, 2024:

New rules:

Volatility rule 1:

If the 3-day Volatility MA rises more than 35% above the 5-day Vol, trading must be stopped until the 3-day Vol MA returns below the 5-day vol MA for a 3 consecutive day period – Vol measured as Open/Close vol. OR until 3-day and 5-day vol MA both make a 4 day low AND 3-day vol is within 20% of the 5-day vol. This ensures I don’t trade in an environment of rising volatility

Volatility Rule 2:

Short strike of the option sold must be at least 1.5 units of the latest 3 day MA vol away from the market price of NQ. In order to accomplish this and get good execution, trades will be placed after open against the direction the market is going in. If I feel that a large continuation of the move might occur then discretion can be used to hold off from trading or to wait and sell options that are much further than the 1.5 units away from open

Trade Execution rule 1:

Only $40-spreads will be sold and a minimum of $8 per contract must be collected

Trade Execution Rule 2:

Each trade must have a max loss of 1/4th of the portfolio. Max loss is calculated as $30(-)Premium received X $20 X contracts sold

Trade Execution Rule 3:

Stop loss of $30/contract will be set for all trades

Trade execution rule 4:

All spreads must have a profit limit sell of $2. This guarantees that if contracts are going towards expiry, they are sold and no funny business happens related to margin requirements at EOD

Tuesday March 5th, 2024:

The week leading up to this week was a really good trading week where I was able to go all 4 trading days without a single losing trade. This might have made me over-confident going into this week. To the point that on Monday when I made $1,000, I felt it wasn’t a lot. Today I was certain that markets would breakout due to the low inflation numbers and NVDA’s bullish chart. This morning when I woke up, I had fomo almost from the moment I got out of bed as the price of NQ had dropped overnight and was at a level I liked. While I went for my coffee and back, the market recovered a bit and I executed my first trade at a strike that was not near one of my key levels. As the market started to go against me, I was confident it would bounce at key levels and added more to my exposure. I had a general idea of my exposure but was not actively calculating. Based on the fact that I lost around $15.65K even though I offset 3k-4k with calls I sold, I must have exposed close to $20K, which is double what my max exposure is supposed to be. The premiums I was selling at weren’t great considering how close to the money I was but I sold more options than normal anyway. I was in a “predicting” pattern of thought as opposed to a risk management pattern of thought. This is the second time this has happened to me after a successful streak. I need to create a morning routine that I abide by every single day to ensure my mindset and quality filters don’t falter. I also need to be really strict with my max exposure rules and not break them. The days leading up to today I had become obsessed with getting to $40K Profits as it was the next milestone before I could double my exposure. This rush to get there led me to abandon my risk management principles today and as a result I paid the price. Going forward I need to focus on the day to day process and not on the potential outcomes if this process ends up being successful or not.

In order to help mitigate this situation in the future I am adding a new “checklist” tab to my risk management sheet that I need to go through every single day. Some of the items will be related to pre-trade activities while others will be related to trading time activities.

Big picture: the experiment is still promising, I just need to add prevention mechanisms so that what happened today is not repeated.

Lessons:

- Don’t become overconfident when you are on a good streak

- Never expose more than your pre-determined max loss amounts

- Don’t try to predict what the market is going to do, focus on trying to determine what is unlikely to happen, and focus on risk management

- Don’t think of prior day or target PNL amounts when you are trading. Focus on the day’s actions and correct trades to make based on what is unfolding

Monday February 19, 2024:

This past week was generally a good week overall. I had a really bad day on Tuesday due to having my position auto-closed by IBKR because my excess liquidity went negative. The trade I placed would have closed at max win but ended up being closed out close to max loss by IBKR instead. The lesson to take away from this is that if I over expose myself I put myself at risk of being margin called, and if I trade in the afternoons I also run the risk of being closed out. For these 2 reasons I must re-calibrate my exposure to exposing $10K max loss on any given trade and to not trading in the afternoons.

The trades where I tend to over-extend myself are trades when the price points I would like to sell at are too far away and I end up selling large spreads at low prices. In the future if I can’t find a price point I want to sell at where I can make sufficient premium without over-exposing myself, then I have to be patient and hope the market action provides an opportunity and if not then I simply don’t trade or trade at much smaller exposure levels. The market will have a large move that quickly puts me and keeps me at my max loss at some point in the near future. The only way to survive that will be to have adequate exposure limits because I won’t know the day when that is going to happen to me.

This week we have the Fed meeting notes being released on Wednesday and Nvidia releasing earnings on Wednesday as well. The market’s bullish trend is being tested so I’ll be watching intently for a change in trend. A large drop at some point this week wouldn’t be shocking so I have to be wary and cautious when selling bull put spreads. On the macroeconomic front it seems cash piles in cash market securities are growing as rates remain elevated and companies continue to stockpile cash. This mixed in with layoffs means that growth is likely to slow down unless rates are dropped soon in order to incentivize the deployment of cash into investments from both retail traders and corporations.

Lessons:

- Don’t chase trades that aren’t there

- You don’t know the day when markets are going to go really against you, so you need to implement appropriate risk-limits every single day

Wednesday February 7th, 2024:

Today I suffered the biggest losses I have suffered to this point. I lost $7,400. There were a few things that I did differently that likely hurt me:

- I was confident that the market would not break through all time highs – this goes against the important principle of letting the market guide me and having no bias to where its going to go. I should simply be selling insurance based on the charts, news and where I think price is unlikely to go. Not where I think the price is likely to go

- I sold the credit spreads at 3 pm the day prior – this goes against my principle of not taking overnight risk. The other reason this is harmful is because it means I have a bias towards one side of the market even before doing my morning analysis

- I stopped checking my risk management spreadsheet before determining how many options to sell and what price I should be selling at

- I didn’t strongly consider the obvious possibility that the markets would break all time highs given how close they were and the bullish patterns forming. I acted on my strong conviction of my interpretation of what news items were important

- I didn’t close out my position after the price target I thought would be troublesome was hit

This can be a learning experience if I take it on the chin and go back to my strict principles.

Lessons:

- No trading anytime except the morning

- I am trying to sell insurance on unlikely events not trying to make predictive bets

- Risk management is the most important factor for longevity

- Every day, both sides should be weighed and strike prices determined based on the technicals and risks. If I feel uncomfortable by the price action I can close at a loss/flat or small gain

- Trade starting closer to 9 AM

- Don’t let fomo guide your trades