This page will be updated after every trade I make in as close to real-time as possible.

Tuesday July 2nd, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bear call spreads with a short strike price of $20,140 and a long strike price of $20,180 for a premium of $8.50 per contract. Netting me a total of $850 in premium ($8.50*5*20). Each contract represents exposure to 20 futures. My max loss here is $3,150. I will be looking to hold them to expiration if possible.

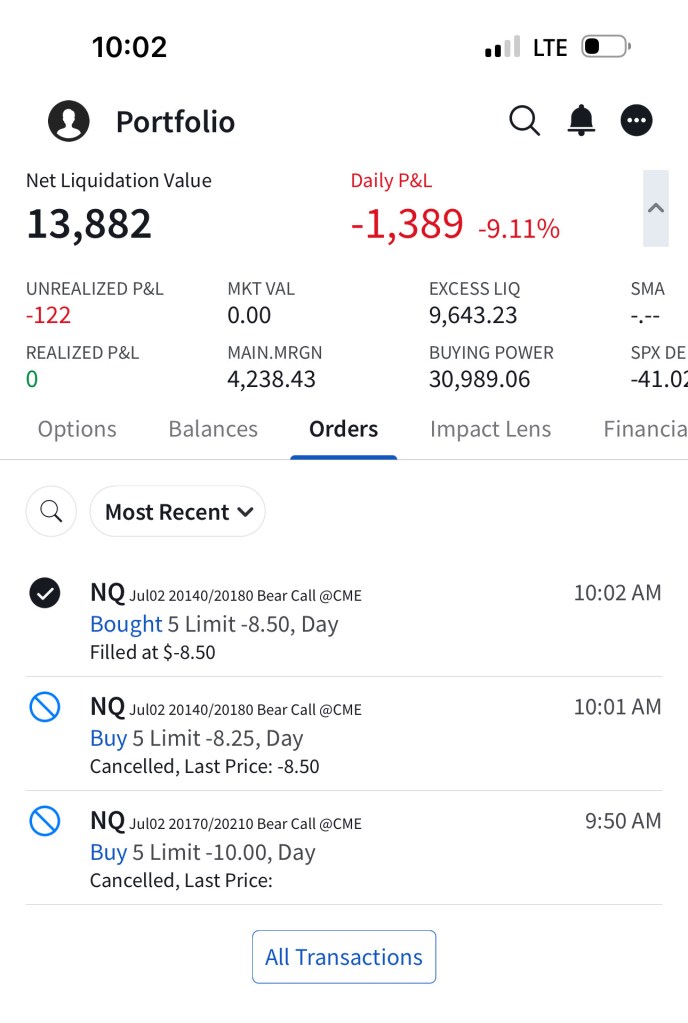

Screenshot of Opening Trade #1:

Trade #2: I have sold 5 more bear call spreads with a short strike price of $20,140 and a long strike price of $20,180 for a premium of $6.75 per contract. Netting me a total of $675 in premium ($6.75*5*20). Each contract represents exposure to 20 futures. My max loss here is $3,325. I will be looking to hold them to expiration if possible.

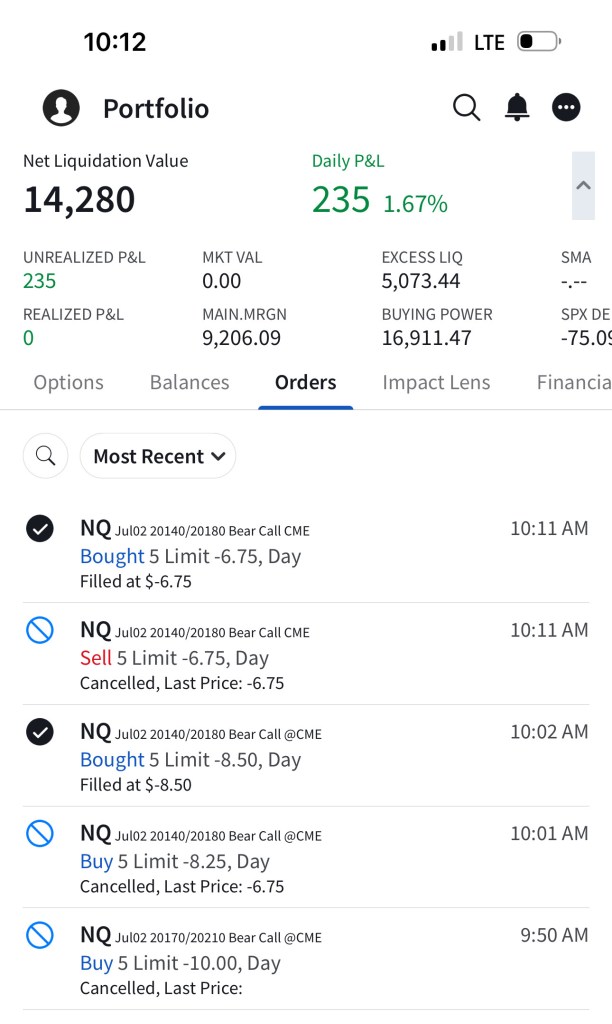

Screenshot of Opening Trade #2:

Monday July 1st, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bear call spreads with a short strike price of $19,990 and a long strike price of $20,030 for a premium of $10.00 per contract. Netting me a total of $1,000 in premium ($10*5*20). Each contract represents exposure to 20 futures. My max loss here is $3,000. I will be looking to hold them to expiration if possible.

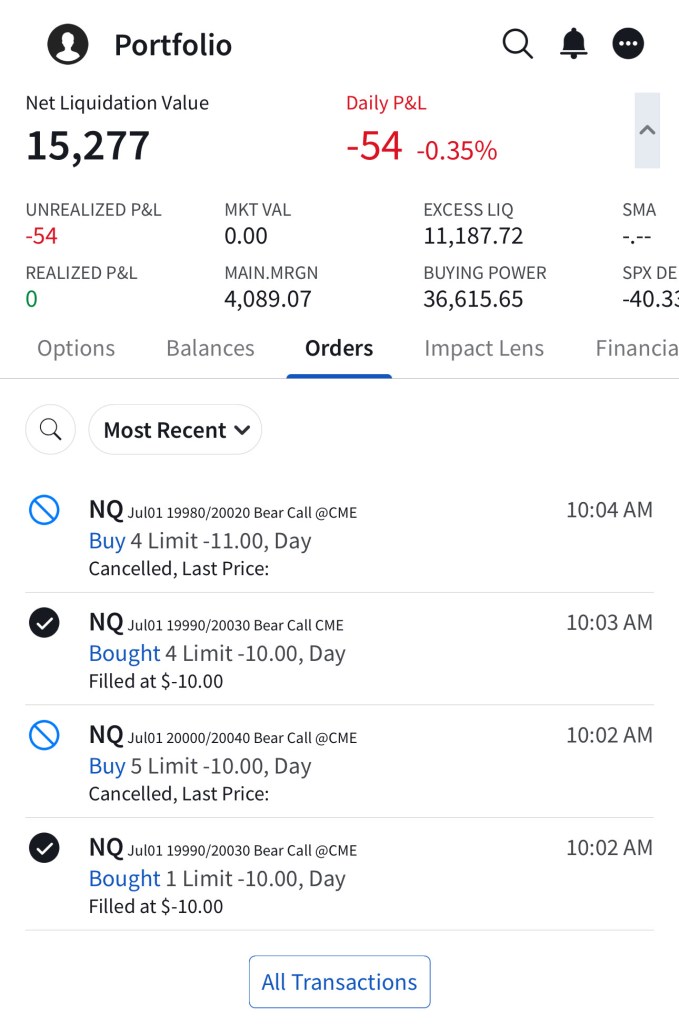

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market traded downwards after I opened my trade so I was able to close my trade for $5/spread, netting me a profit of $5/spread which is equal to a total loss of $500 ($5*20*5). Total trade time was 8 minutes (10:04 AM – 10:12 AM).

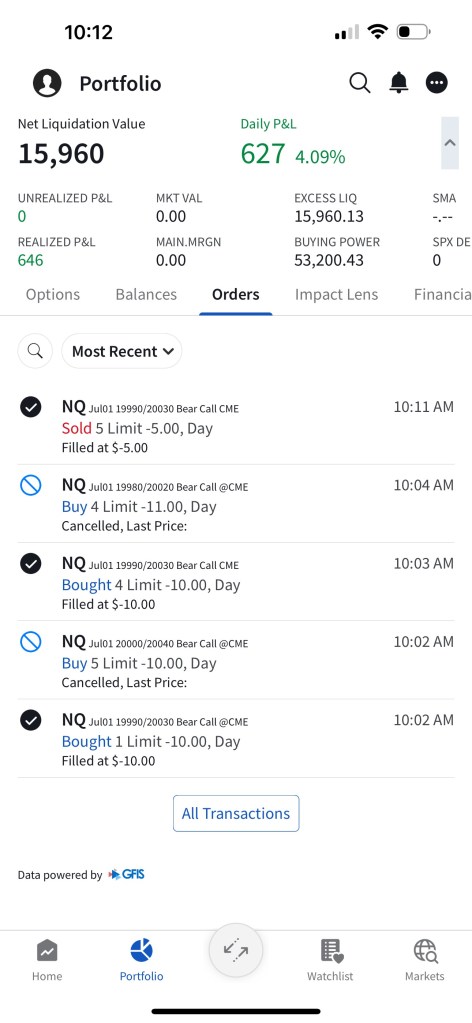

Screenshot of Closing Trade #1:

Trade #2: I have sold another 5 bear call spreads with a short strike price of $19,980 and a long strike price of $20,020 for a premium of $10.00 per contract. Netting me a total of $1,000 in premium ($10*5*20). Each contract represents exposure to 20 futures. My max loss here is $3,000. I will be looking to hold them to expiration if possible.

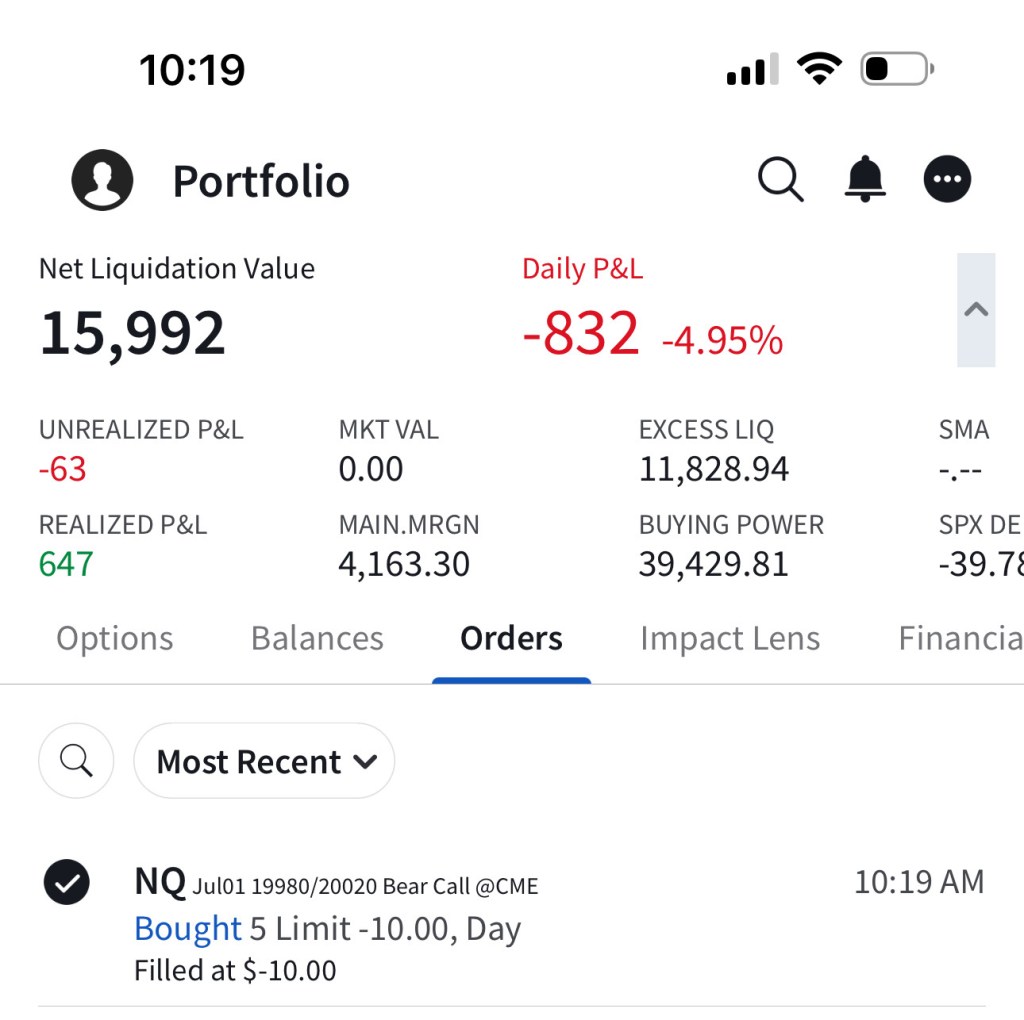

Screenshot of Opening Trade #2:

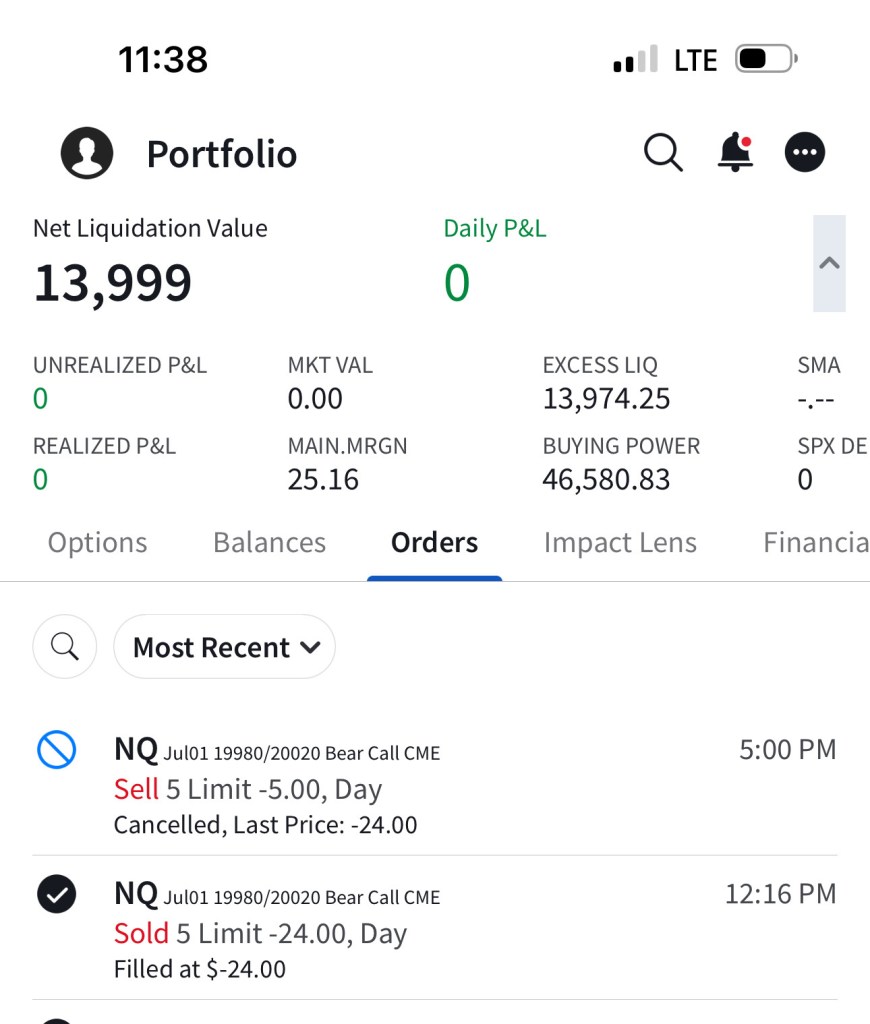

Closing out Trade #2:

The market traded upwards after I opened my trade so I had to close my trade for $23.50/spread, netting me a loss of $14/spread which is equal to a total loss of $1,400 ($14*20*5). Total trade time was 1 hour and 57 minutes (10:19 AM – 12:16 PM).

Screenshot of Closing Trade #2:

Friday June 27th, 2024:

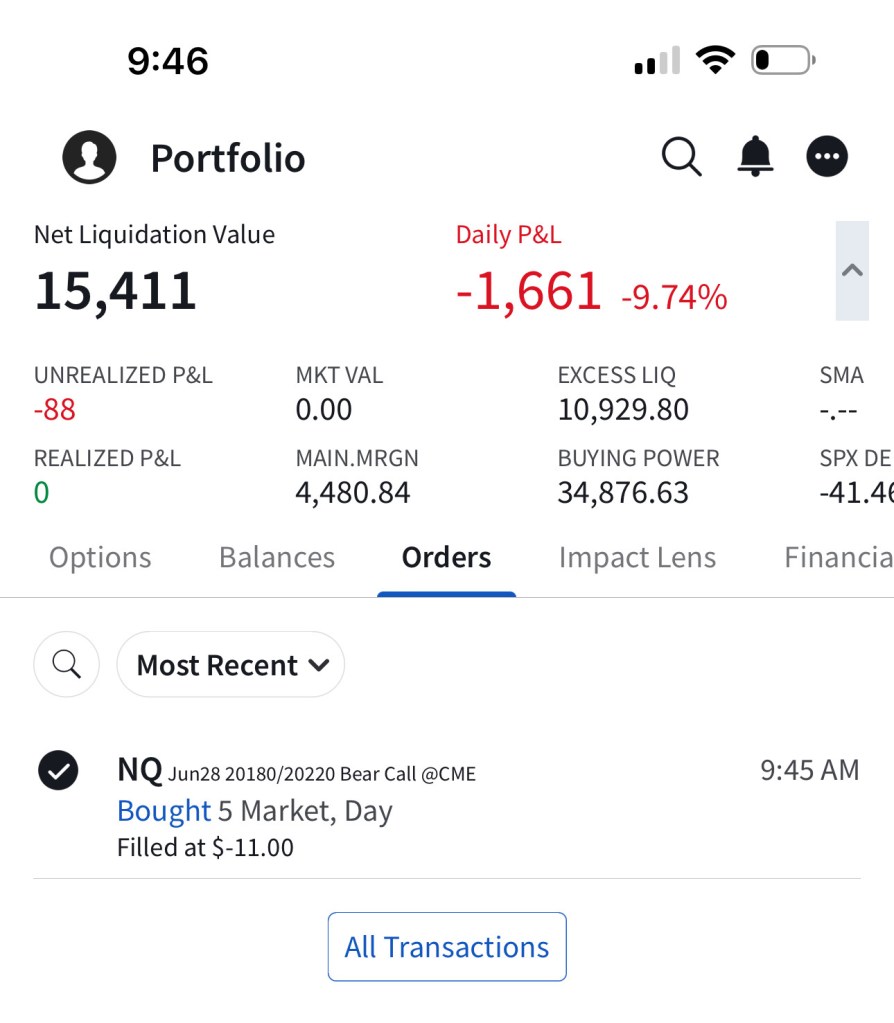

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bear call spreads with a short strike price of $20,180 and a long strike price of $20,220 for a premium of $11.00 per contract. Netting me a total of $1,100 in premium ($11*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,900. I will be looking to close if and when NQ makes a move to the downside.

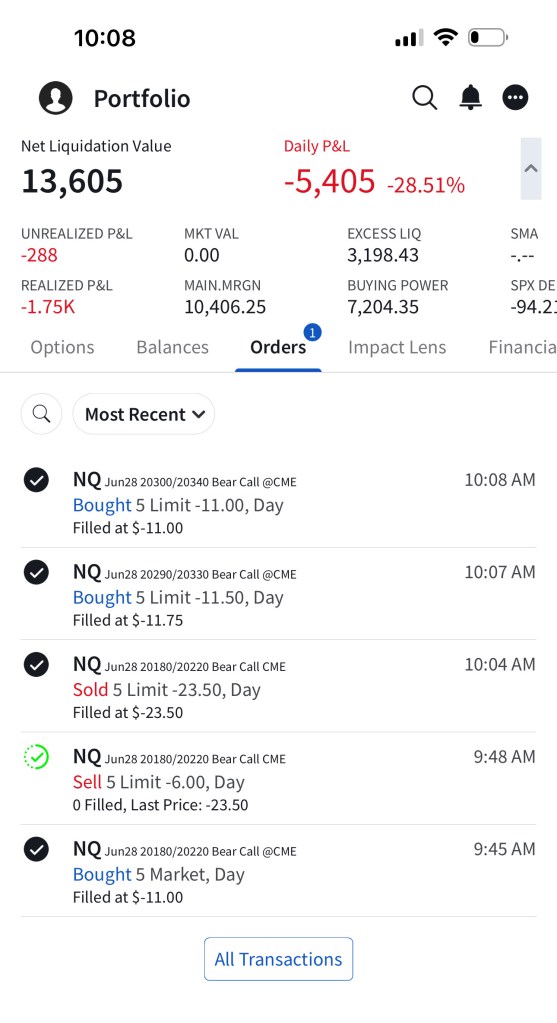

Screenshot of Opening Trade #1:

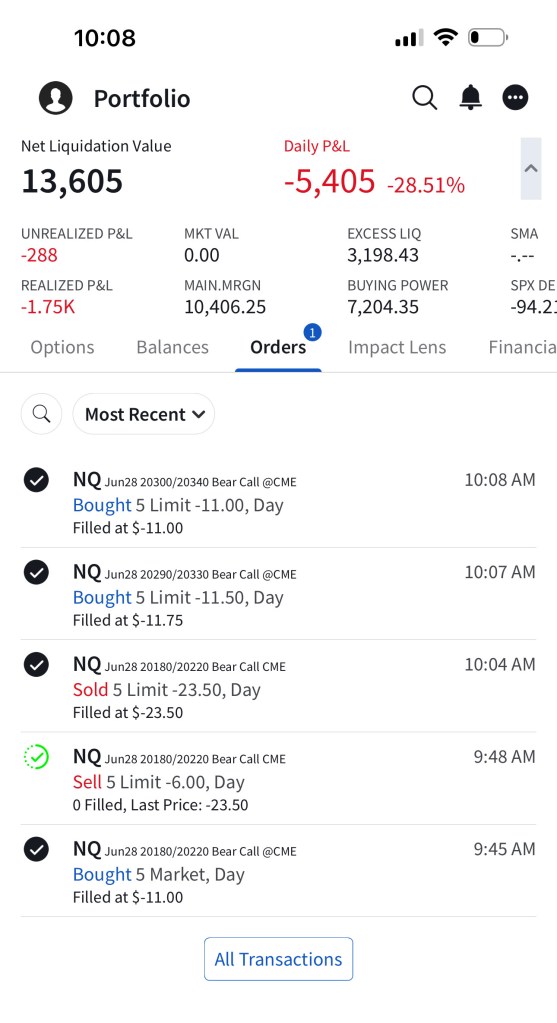

Closing out Trade 1:

The market traded upwards after I opened my trade so I had to close my trade for $23.50/spread, netting me a loss of $12.5/spread which is equal to a total loss of $1,250 ($12.5*20*5). Total trade time was 19 minutes (9:45 AM – 10:04 AM).

Screenshot of Closing Trade #1:

Trade #2 and Trade #3:

I have sold 5 bear call spreads with a short strike price of $20,290 and a long strike price of $20,330 for a premium of $11.75 per contract. Netting me a total of $1,175 in premium ($11.75*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,825. I will be looking to close if and when NQ makes a move to the downside.

I have also sold 5 bear call spreads with a short strike price of $20,300 and a long strike price of $20,340 for a premium of $11.00 per contract. Netting me a total of $1,100 in premium ($11.00*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,900. I will be looking to close if and when NQ makes a move to the downside.

Screenshot of Opening Trade #2 and #3:

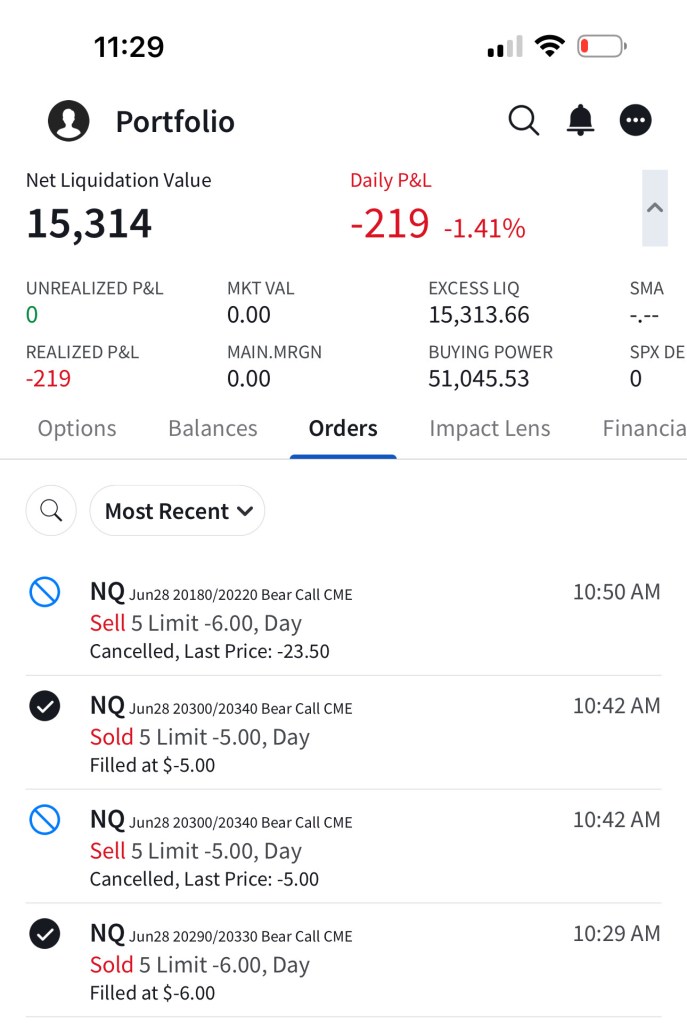

Closing out Trade 2 and 3:

The market traded downwards after I opened my trade so I was able to close my trades for $6/spread for trade #2 and $5/spread for trade #3, netting me a profit of $5.75/spread and $6.00/spread which is equal to a total profit of $1,175 ($5.75*20*5+$6*20*5). Total trade time was 34 minutes (10:07 AM – 10:41 AM) for trade #2 and 40 minutes (10:08 AM – 10:48 AM) for trade #3.

Screenshot of Closing Trade #2 and Trade #3:

Thursday June 26th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bear call spreads with a short strike price of $20,070 and a long strike price of $20,110 for a premium of $12.60 per contract. Netting me a total of $1,260 in premium ($12.60*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,740. I will be looking to close if and when NQ makes a move to the downside.

Closing out Trade 1:

The market traded upwards after I opened my trade so I had to close my trade for $23.50/spread, netting me a loss of $7.40/spread which is equal to a total loss of $740 ($7.4*20*5). Total trade time was 51 minutes (9:32 AM – 10:23 AM).

Screenshot of Opening and Closing Trade #1:

Wednesday June 26th, 2024:

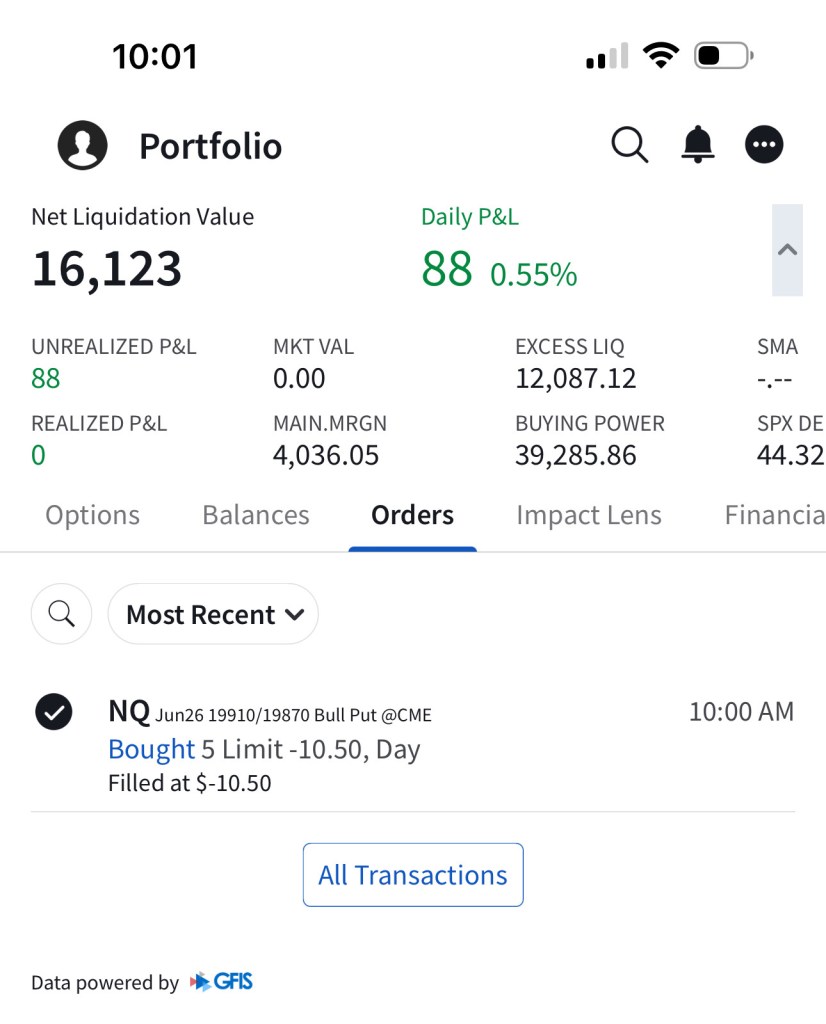

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bull put spreads with a short strike price of $19,910 and a long strike price of $19,870 for a premium of $10.50 per contract. Netting me a total of $1,050 in premium ($10.50*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,950. I will be looking to close if and when NQ makes a move to the upside.

Screenshot of Opening Trade #1:

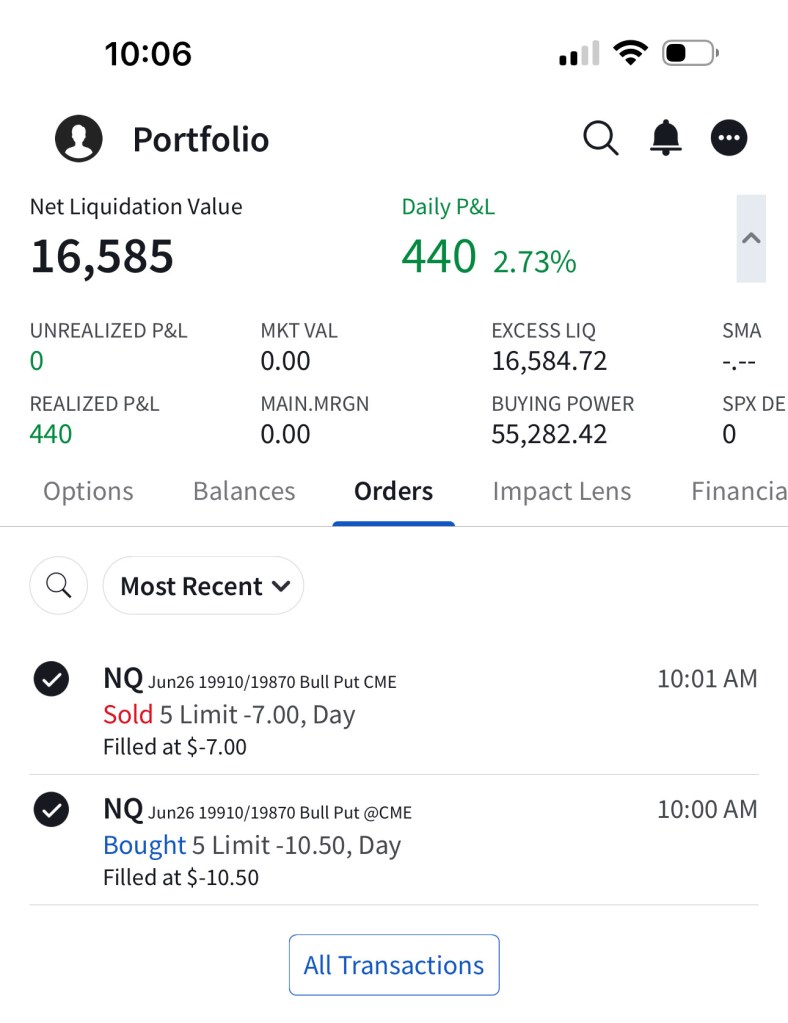

Closing out Trade 1:

The market traded upwards after I opened my trade so I was able to close my trade for $7.00/spread, netting me a profit of $3.5/spread which is equal to a total profit of $350 ($3.50*20*5). Total trade time was 5 minutes (10:01 AM – 10:06 AM).

Screenshot of Closing Trade #1:

Tuesday June 25th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bull put spreads with a short strike price of $19,800 and a long strike price of $19,760 for a premium of $10.75 per contract. Netting me a total of $1,075 in premium ($10.75*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,925. I will be looking to close if and when NQ makes a move to the downside.

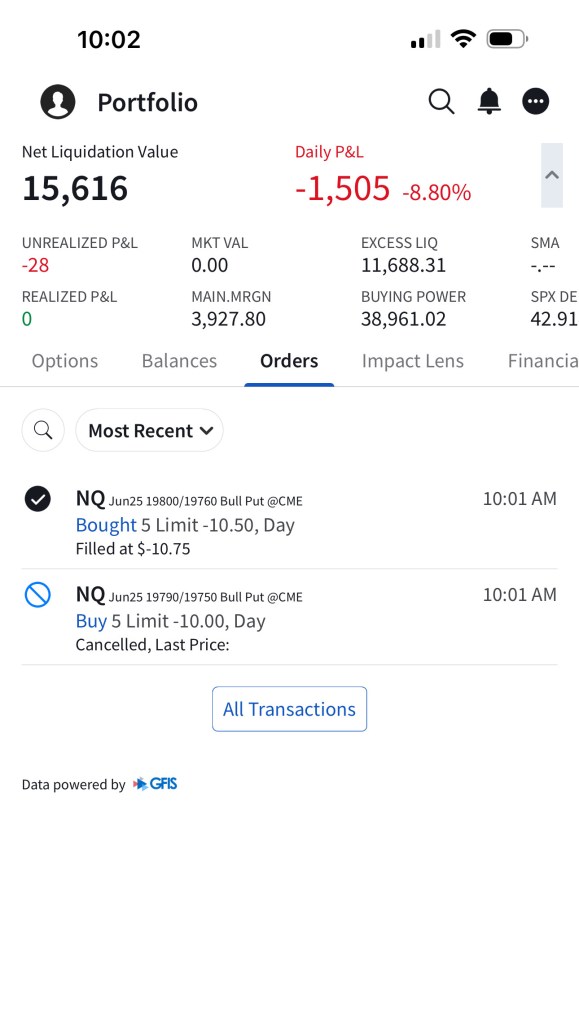

Screenshot of Opening Trade #1:

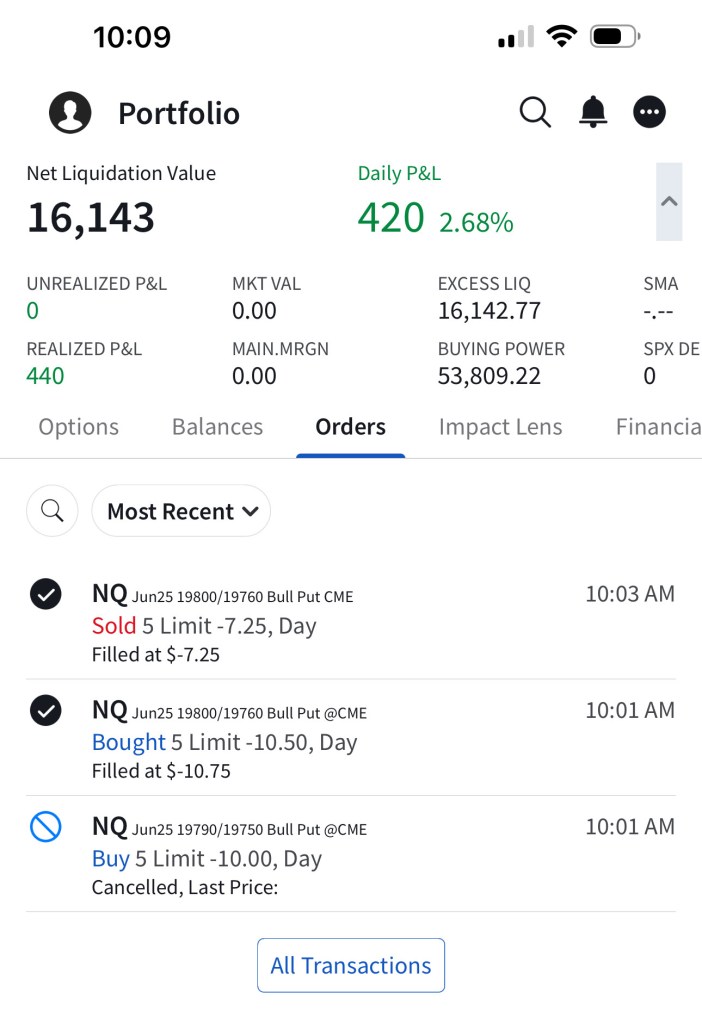

Closing out Trade 1:

The market traded upwards after I opened my trade so I was able to close my trade for $7.25/spread, netting me a profit of $3.5/spread which is equal to a total profit of $350 ($3.50*20*5). Total trade time was 8 minutes (10:01 AM – 10:09 AM).

Screenshot of Closing Trade #1:

Monday June 24th, 2024:

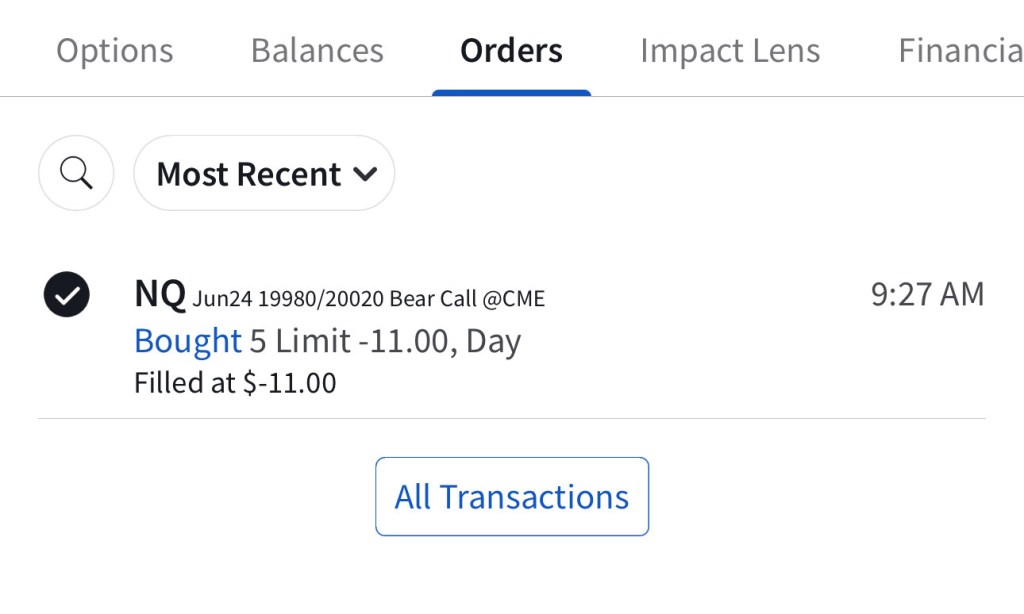

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have sold 5 bear call spreads with a short strike price of $19,980 and a long strike price of $20,020 for a premium of $11.00 per contract. Netting me a total of $1,100 in premium ($11*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,900. I will be looking to close if and when NQ makes a move to the downside.

Screenshot of Opening Trade #1:

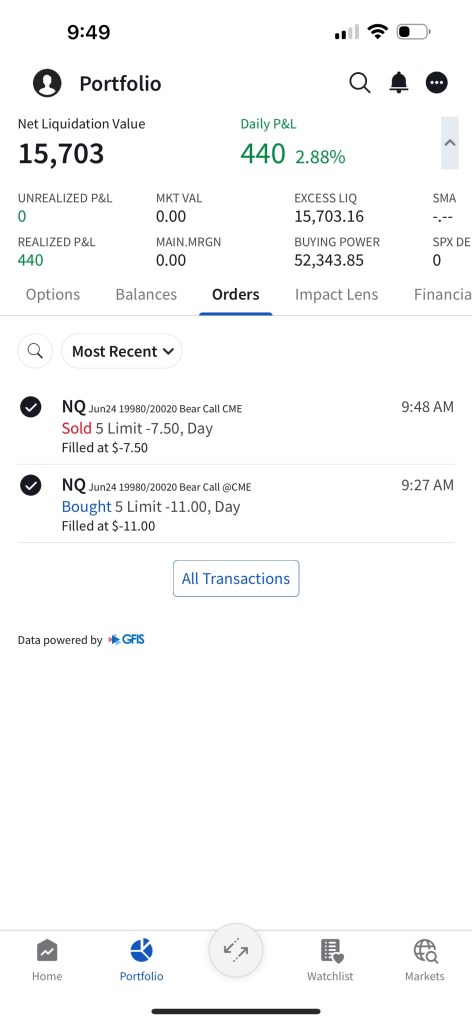

Closing out Trade 1:

The market traded downwards after I opened my trade so I was able to close my trade for $7.5/spread, netting me a profit of $3.5/spread which is equal to a total profit of $350 ($3.50*20*5). Total trade time was 21 minutes (9:27 AM – 9:48 AM).

Screenshot of Closing Trade #1:

Friday June 21st, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I had to make a slight adjustment as the NQ contract that I had to trade today is the one expiring September. The resistance of $20,130 I mentioned in Tomorrow’s Trade Ideas was too far off from the current market price since NQ fell convincingly below its $20,000 support. I am now using the $20,000 level as my new reference resistance level and I have sold 5 bear call spreads with a short strike price of $20,020 and a long strike price of $20,060 for a premium of $11.50 per contract. Netting me a total of $1,150 in premium ($12*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,850. I will be looking to close if and when NQ makes a move to the downside.

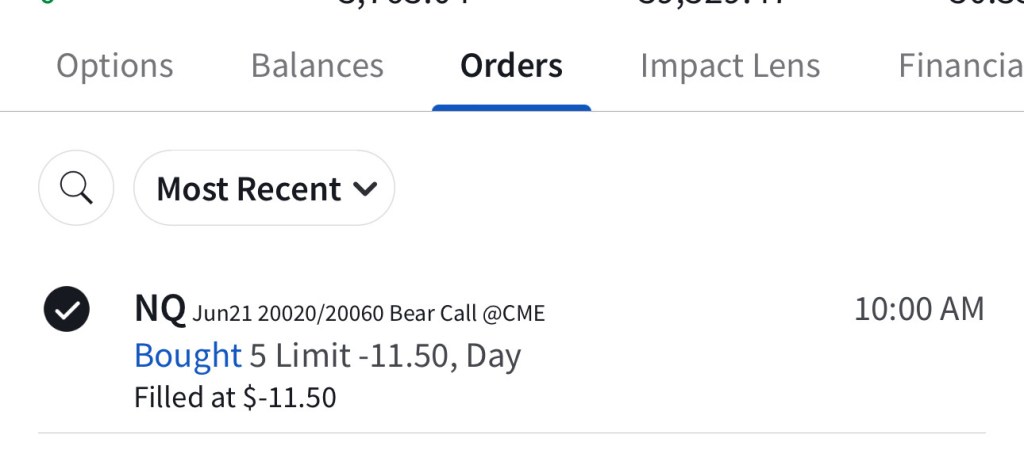

Screenshot of Opening Trade #1:

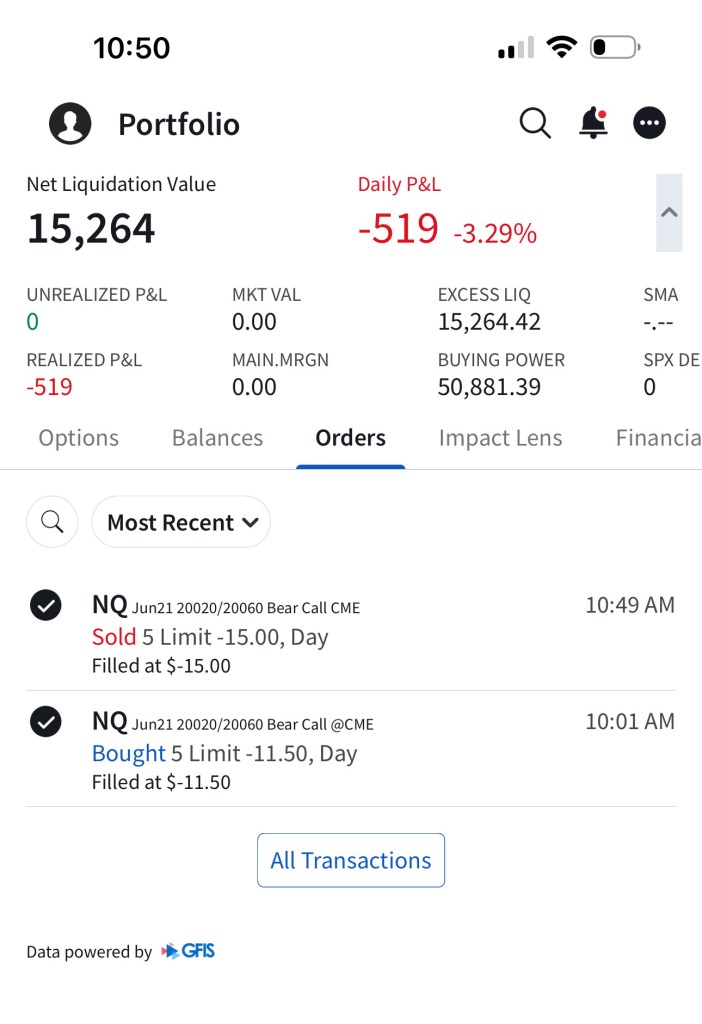

Closing out Trade 1:

The market traded upwards after I opened my trade and the trade was getting close to my max holding period of an hour so I had to close out my bear call spreads for $15/spread, netting me a loss of $3.5/spread which is equal to a total loss of $350 ($3.50*20*5). Total trade time was 50 minutes (10:00 AM – 10:50 AM).

Screenshot of Closing Trade #1:

Thursday June 20th, 2024:

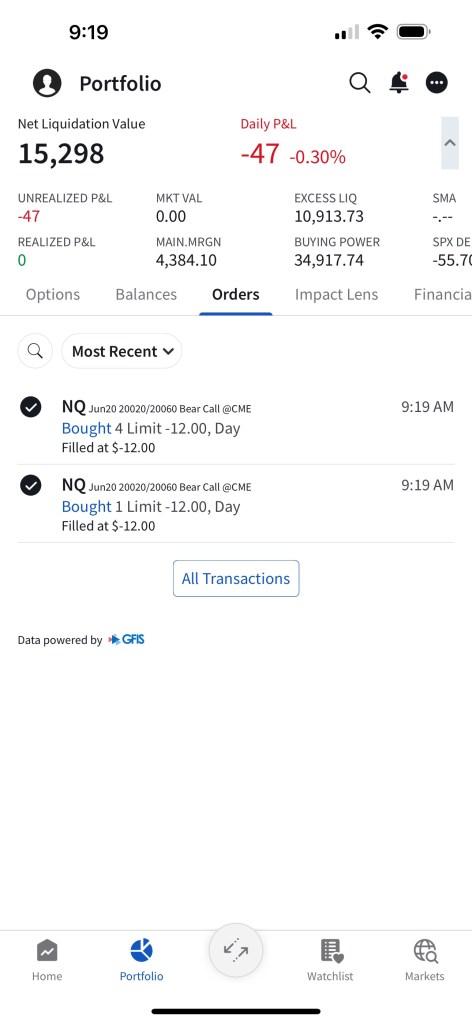

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I had to make a slight adjustment as the NQ contract that is currently the one being shown in TradingView (The one expiring Sep 20) is not liquid enough, so I continued to trade the one expiring June 21st. The resistance of $20,275 I mentioned in Tomorrow’s Trade Ideas is equivalent to a resistance of $20,000 for the June 21 NQ contract. I have sold 5 bear call spreads with a short strike price of $20,020 and a long strike price of $20,060 for a premium of $12 per contract. Netting me a total of $1,200 in premium ($12*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,800. I will be looking to close if and when NQ makes a move to the downside.

Screenshot of Opening Trade #1:

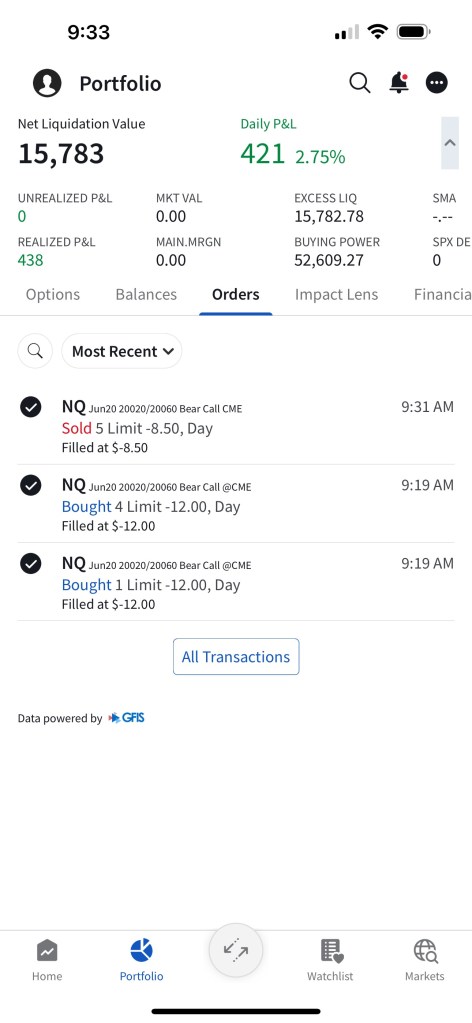

Closing out Trade 1:

The market dropped shortly after I opened my trade so I was able to close out my bear call spreads for $8.5/spread, netting me a profit of $3.5/spread which is equal to a total return of $350 ($3.50*20*5). Total trade time was 12 minutes (9:19 AM – 9:31 AM).

Screenshot of Closing Trade #1:

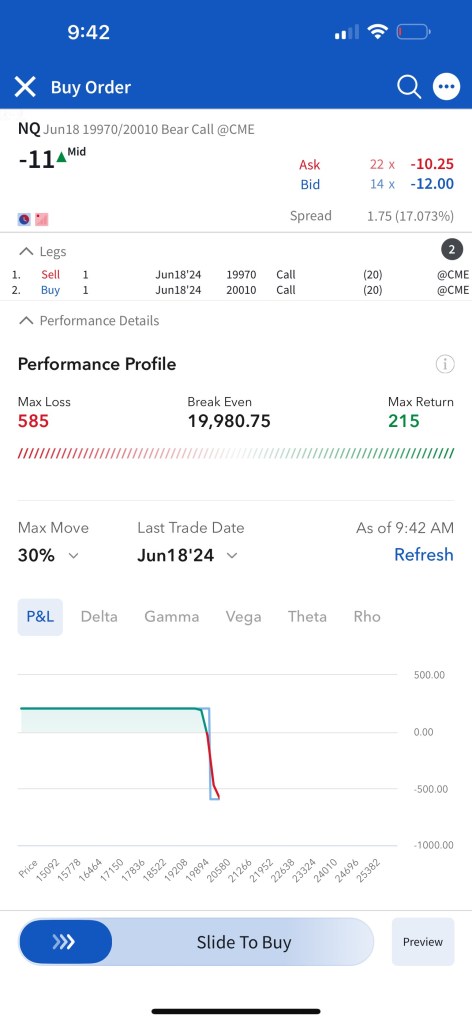

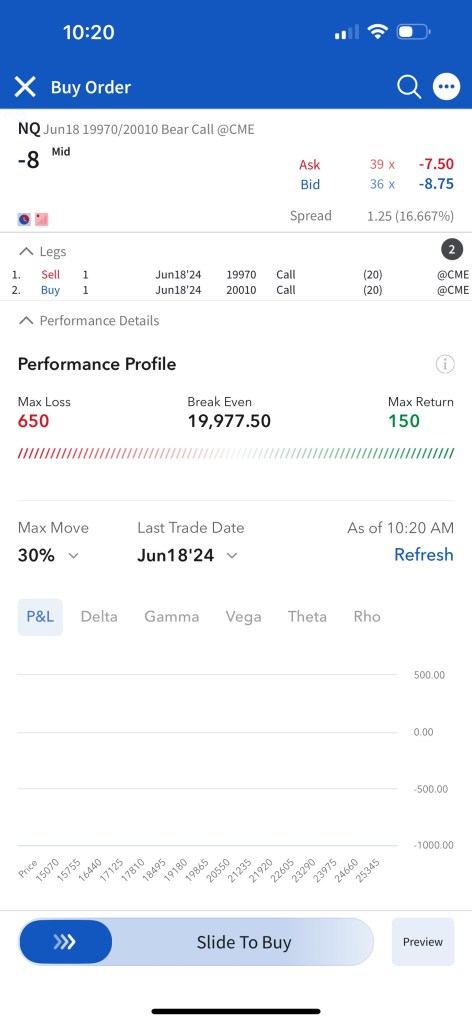

Tuesday June 18th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I had to make a slight adjustment as the NQ contract that is currently the one being shown in TradingView (The one expiring Sep 20) is not liquid enough, so I continued to trade the one expiring June 21st. The resistance of $20,200 I mentioned in Tomorrow’s Trade Ideas is equivalent to a resistance of $19,900 for the June 21 NQ contract. I have “paper” sold 5 bear call spreads with a short strike price of $19,970 and a long strike price of $20,010 for a premium of $11 per contract. Netting me a total of $1,100 in premium ($11*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,900. I will be looking to close if and when NQ makes a move to the downside. Since it’s a paper trade, I assumed a price of $11 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market dropped shortly after I opened my trade so I was able to close out my bear call spreads for $8/spread, netting me a profit of $3/spread which is equal to a total return of $300 ($3*20*5). Total trade time was 38 minutes (9:42 AM – 10:20 AM). Again, since its a paper trade I assumed a price of $8 as it is the mid-point of the bid and ask.

Screenshot of Closing Trade #1:

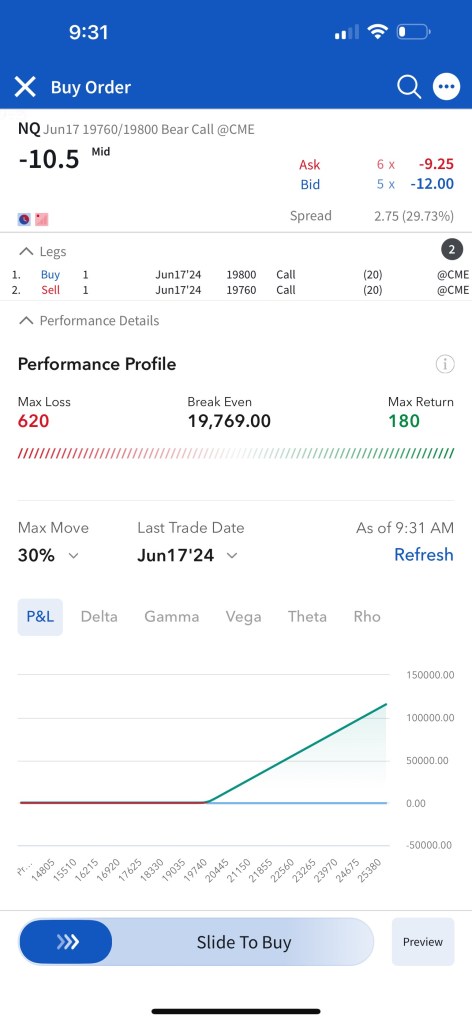

Monday June 17th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I had to make a slight adjustment as the NQ contract that is currently the one being shown in TradingView (The one expiring Sep 20) is not liquid enough, so I continued to trade the one expiring June 21st. The resistance of $20,000 I mentioned in Tomorrow’s Trade Ideas is equivalent to a resistance of $19,750 for the June 21 NQ contract. I have “paper” sold 5 bear call spreads with a short strike price of $19,760 and a long strike price of $19,800 for a premium of $10.50 per contract. Netting me a total of $1,050 in premium ($10.50*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,950. I will be looking to close if and when NQ makes a move to the downside. Since it’s a paper trade, I assumed a price of $10.50 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market dropped shortly after I opened my trade so I was able to close out my bear call spreads for $6.5/spread, netting me a profit of $4/spread which is equal to a total return of $400 ($4*20*5). Total trade time was 13 minutes (9:31 AM – 9:44 AM). Again, since its a paper trade I assumed a price of $6.50 as it is the mid-point of the bid and ask.

Screenshot of Closing Trade #1:

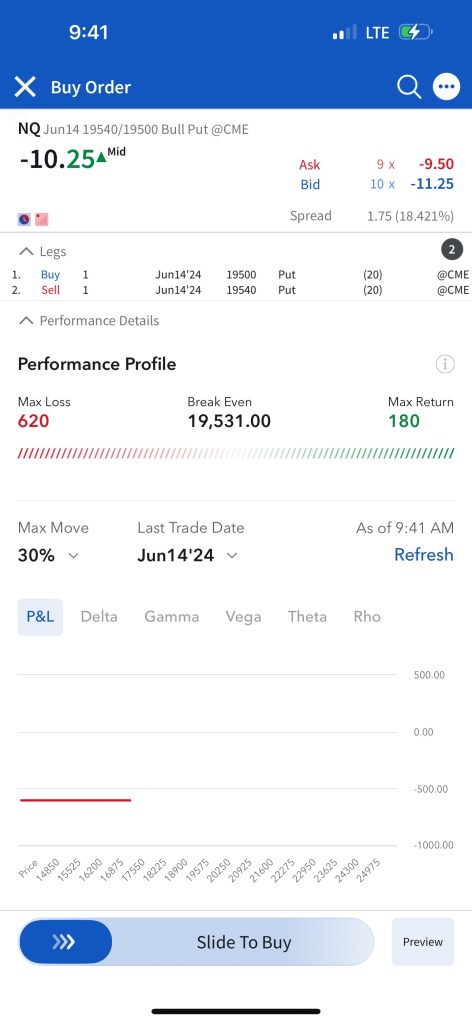

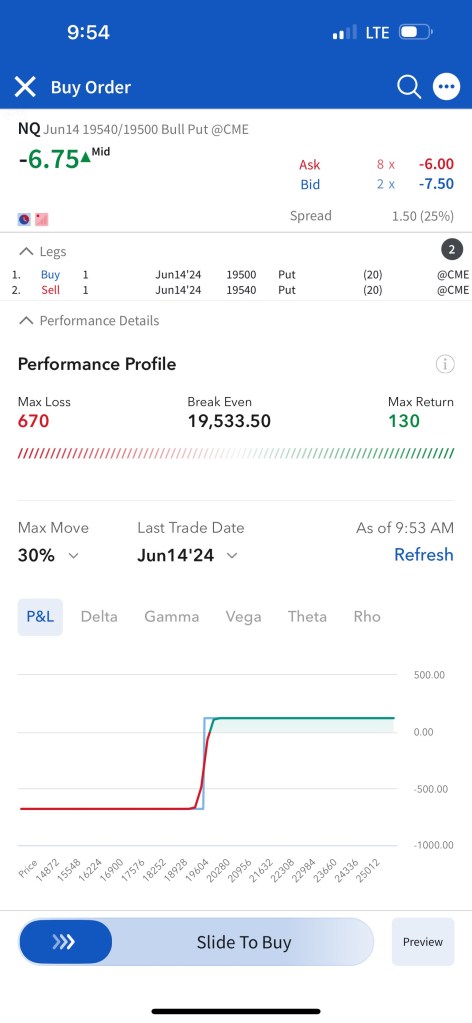

Friday June 14th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I had to make a slight adjustment as the NQ contract that is currently the one being shown in TradingView (The one expiring Sep 20) is not liquid enough, so I continued to trade the one expiring June 21st. The support of $19,800 I mentioned in Tomorrow’s Trade Ideas is equivalent to a support of $19,550 for the June 21 NQ contract. I have “paper” sold 5 bull put spreads with a short strike price of $19,540 and a long strike price of $19,500 for a premium of $10.25 per contract. Netting me a total of $1,025 in premium ($10.25*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,975. I will be looking to close if and when NQ makes a move to the upside. Since it’s a paper trade, I assumed a price of $10.25 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market bounced higher shortly after I opened my trade so I was able to close out my bull put spreads for $6.75/spread, netting me a profit of $3.5/spread which is equal to a total return of $350 ($3.5*20*5). Total trade time was 13 minutes (9:41 AM – 9:54 AM). Again, since its a paper trade I assumed a price of $6.75 as it is the mid-point of the bid and ask.

Screenshot of Closing Trade #1:

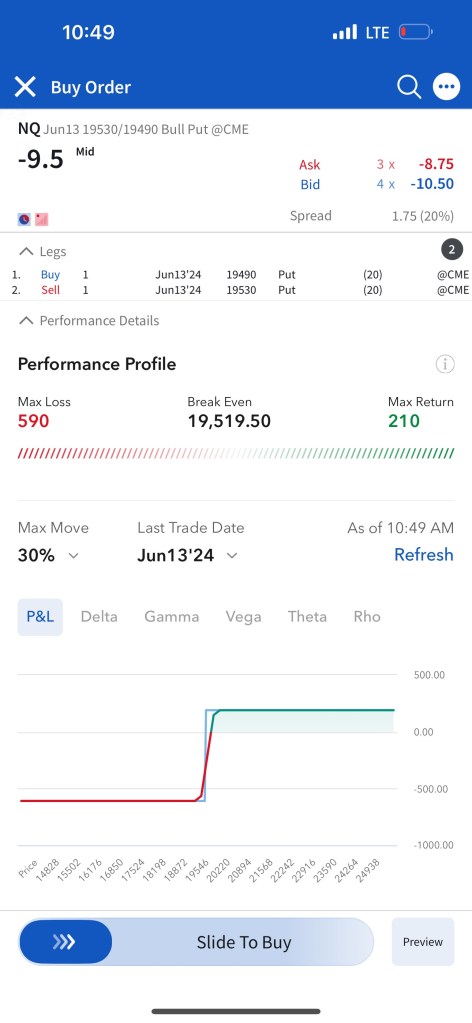

Thursday June 13th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I had to make a slight adjustment as the NQ contract that is currently the one being shown in TradingView (The one expiring Sep 20) is not liquid enough, so I continued to trade the one expiring June 21st. The support of $19,800 I mentioned in Tomorrow’s Trade Ideas is equivalent to a support of $19,550 for the June 21 NQ contract. I have “paper” sold 5 bull put spreads with a short strike price of $19,530 and a long strike price of $19,490 for a premium of $10.25 per contract. Netting me a total of $1,025 in premium ($10.25*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,975. I will be looking to close if and when NQ makes a move to the upside. Since it’s a paper trade, I assumed a price of $10.25 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market went lower and I was at an unrealized loss for a bit, then it hovered around the same price where I entered for 10 mins. The chart wasn’t giving me a feeling that it would hold the $19,550 support so I decided to close the trade at a small gain. I closed out my bull put spreads for $9.5/spread, netting me a profit of $0.75/spread which is equal to a total return of $75 ($0.75*20*5). Total trade time was 33 minutes (10:16 AM – 10:46 AM). Again, since its a paper trade I assumed a price of $9.5 as it is the mid-point of the bid and ask.

This will be my only trade for today.

Wednesday June 12th, 2024:

No trades today. I don’t trade on FOMC rate decision days

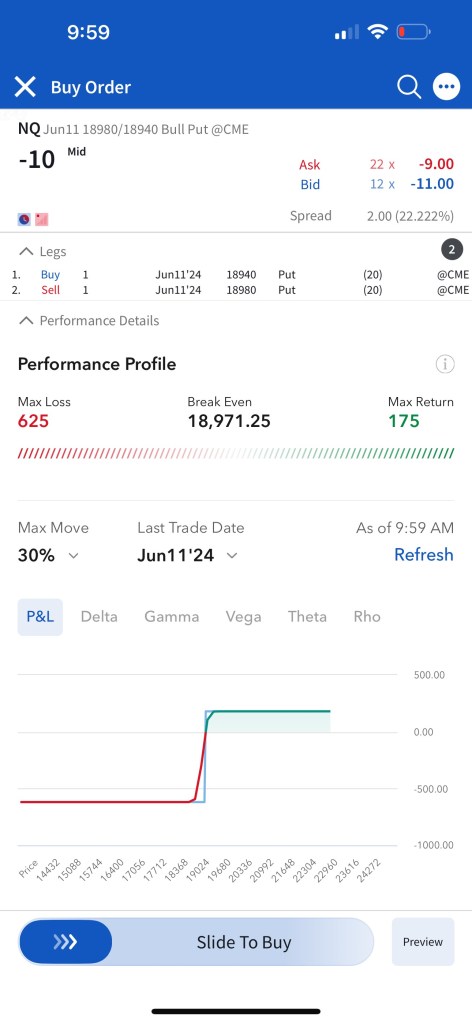

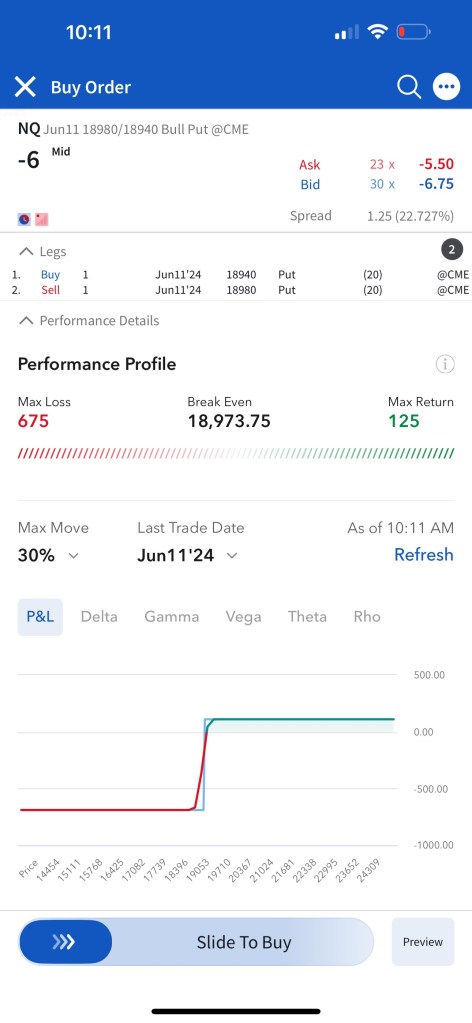

Tuesday June 11th, 2024:

Trade #1: I have decided to sell bull put spreads instead of the bear call spreads I had mentioned I would be looking to sell today in Tomorrow’s Trade Ideas. The market didn’t provide me a good opportunity to sell the bear call spreads as it was dropping most morning. After dropping close to the $18,985 soft support however, it bounce higher indicating a rejection of that support. This along with my analysis that we shouldn’t see a large move in either direction gave me confidence to paper sell 5 bull put spreads with a short strike of $18980 and a long strike of $18940 for a premium of $10 per contract. Netting me a total of $1000 in premium ($10*5*20). Each contract represents exposure to 20 futures. My max loss here is $3000. I will be looking to close if and when NQ makes a move to the upside. Since it’s a paper trade, I assumed a price of $10.00 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market bounced higher shortly after I opened my trade so I was able to close out my bull put spreads for $6/spread, netting me a profit of $4/spread which is equal to a total return of $400 ($4*20*5). Total trade time was 12 minutes (9:59 AM – 10:11 AM). Again, since its a paper trade I assumed a price of $6.00 as it is the mid-point of the bid and ask.

Screenshot of Closing Trade #1:

This will be my only trade for today.

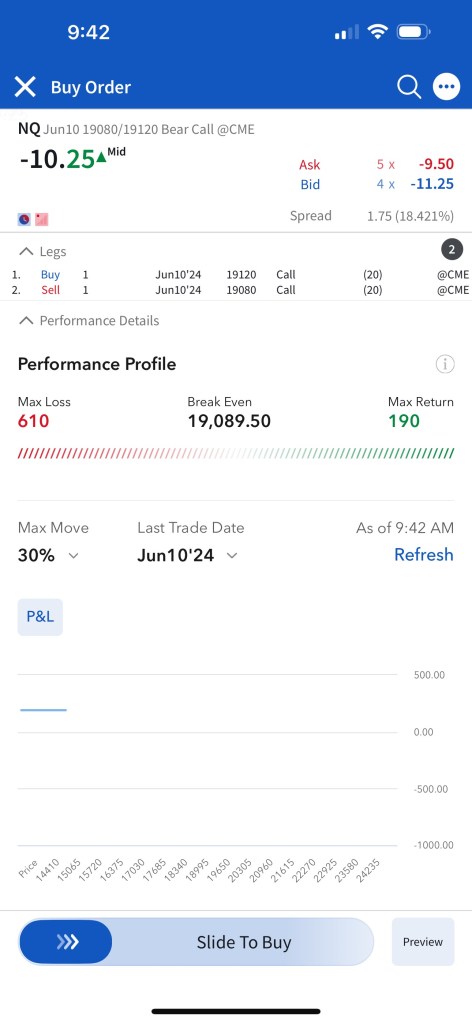

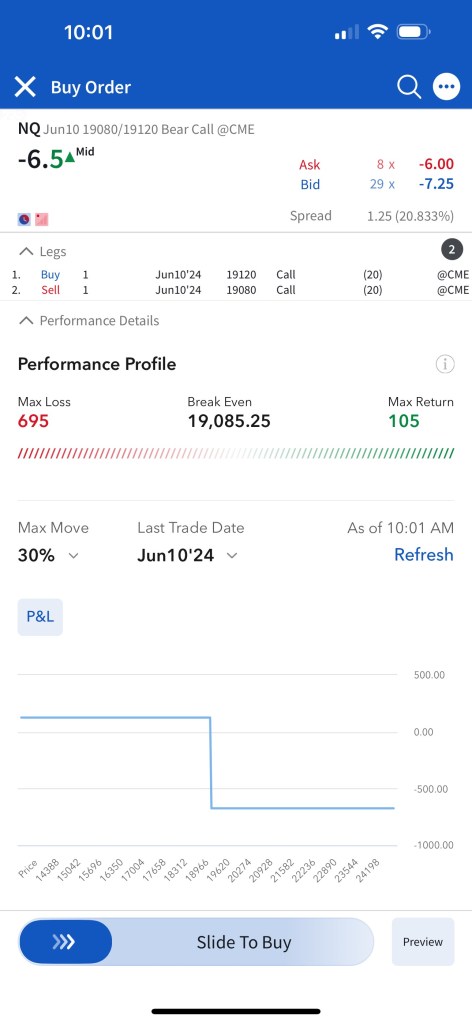

Monday, June 10th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have “paper” sold 5 bear call spreads with a short strike price of $19,080 and a long strike price of $19,120 for a premium of $10.25 per contract. Netting me a total of $1,025 in premium ($10.25*5*20). Each contract represents exposure to 20 futures. My max loss here is $2,975. I will be looking to close if and when NQ makes a move to the downside in the first 1 hour of trading. Since it’s a paper trade, I assumed a price of $10.25 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market was flat between the $19,025 and $19,000 levels the for first few minutes after market open. This allowed me to open up my trade when the market was close the $19,025 level. Just 19 minutes later the market dropped to the $19,000 level and I was able to close my bear call spreads for $6.50/spread, netting me a profit of $3.75/spread which is equal to a total return of $375 ($3.75*20*5). Total trade time was 19 minutes (9:42 AM – 10:01 AM). Again, since its a paper trade I assumed a price of $6.25 as it is the mid-point of the bid and ask.

This will be my only trade for today.

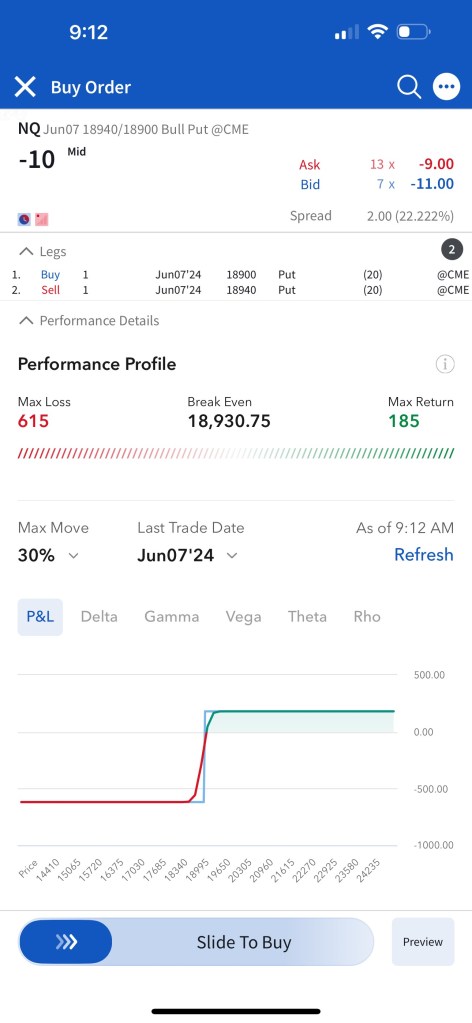

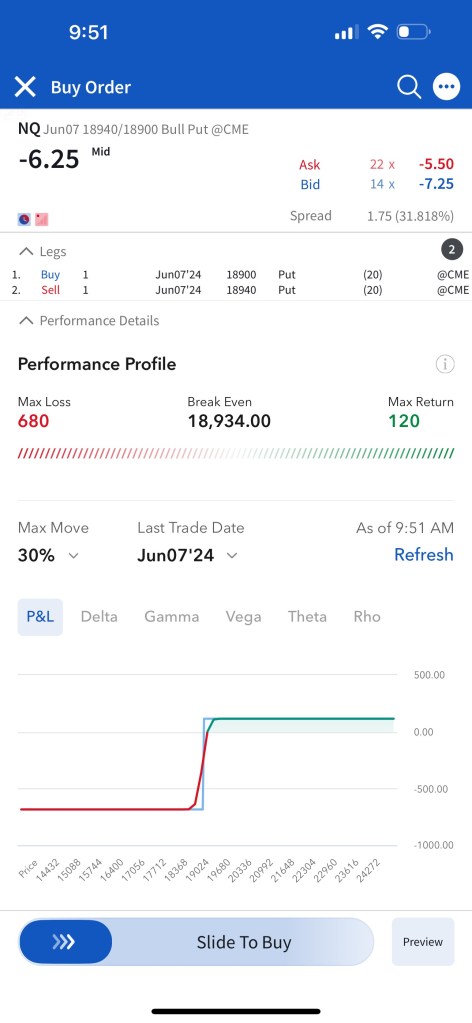

Friday, June 7th, 2024:

Trade #1: I have followed through on the trade plan mentioned yesterday in Tomorrow’s Trade Ideas. I have “paper” sold 5 bull put spreads with a short strike price of $18,940 and a long strike price of $18,900 for a premium of $10 per contract. Netting me a total of $1,000 in premium ($10*5*20). Each contract represents exposure to 20 futures. My max loss here is $3,000. I will be looking to close if and when NQ makes a move to the upside in the first 1 hour of trading. Since it’s a paper trade, I assumed a price of $10 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

Closing out Trade 1:

The market was flat for the first few minutes and then made a small move higher and a great portion of the time value of the spreads I sold this morning was sucked out. This allowed me to close out my bull put spreads at $6.25/spread, netting me a profit of $3.75/spread which is equal to a total return of $375 ($3.75*20*5). Total trade time was 39 minutes (9:12 AM – 9:51 AM). Again, since its a paper trade I assumed a price of $6.25 as it is the mid-point of the bid and ask.

Screenshot of Closing Out Trade #1:

This will be my only trade for today.

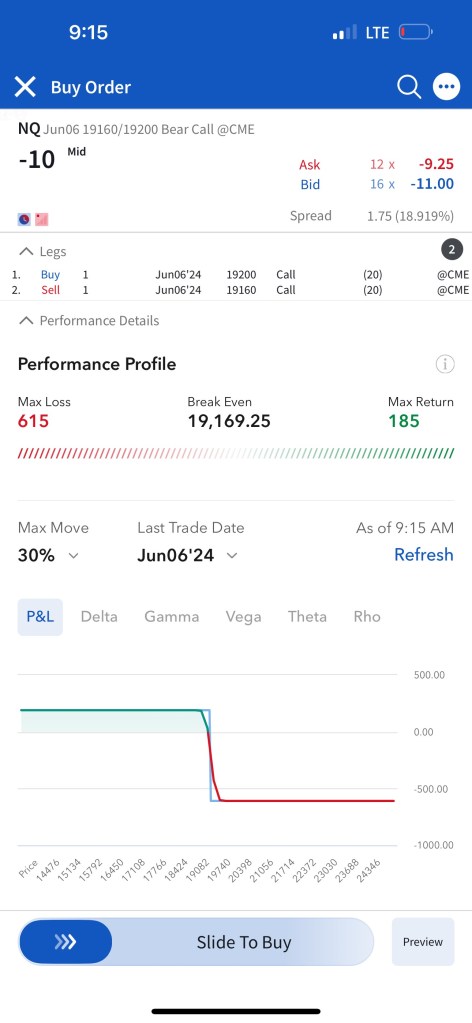

Thursday, June 6th, 2024:

Trade #1: As mentioned yesterday in Tomorrow’s Trade Ideas I have “paper” sold 5 bear call spreads with a short strike price of $19,160 and a long strike price of $19,200 for a premium of $10 per contract. Netting me a total of $1,000 in premium ($10*5*20). Each contract represents exposure to 20 futures. My max loss here is $3,000. I will be looking to close when we approach the support mentioned in my post from yesterday. Since it’s a paper trade, I assumed a price of $10 which is the mid-point between the bid and the ask as shown in the screenshot.

Screenshot of Opening Trade #1:

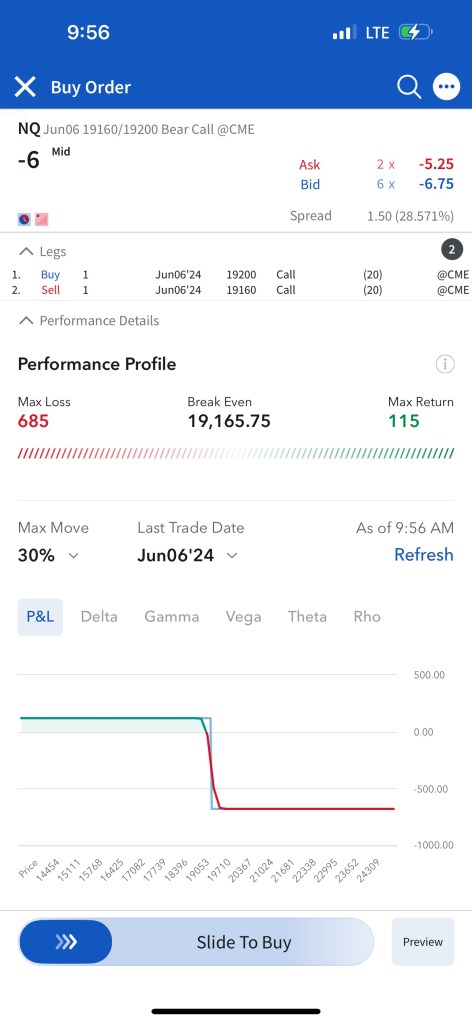

Closing out Trade 1:

The market turned lower and a great portion of the time value of the spreads I sold this morning was sucked out. This allowed me to close out my bear call spreads at $6/spread, netting me a profit of $4/spread which is equal to a total return of $400 ($4*20*5). Total trade time was 41 minutes (9:15 AM – 9:56 AM). Again, since its a paper trade I assumed a price of $6 as it is the mid-point of the bid and ask.

Screenshot of Closing Out Trade #1:

This will be my only trade for today.